What Challenges Do Personal Accident Cover Holders Face in Canada? Find Their Solutions!

What comes to your mind when you hear ‘personal accident cover’? That it protects us from unexpected injuries or accidents, right?

Despite the security it offers, the policyholders face some hidden challenges. Understanding them along with personal accident cover meaning is important. It helps them to achieve comprehensive coverage and peace of mind.

So, join us as we explore the challenges of the cover holders in Canada, aiming to understand and discover solutions.

What’s Personal Accident Cover?

Personal accident cover is a type of insurance that provides financial protection if you get hurt in an accident/event. If you have this cover, it can help pay for medical bills, hospital stays, and sometimes even lost wages if you can’t work because of your injury.

In Canada, the personal accident cover works similarly to how it does in other places.

Let’s say, Mrs. Hannah, a 45-year-old female, has the insurance. One day while she was driving her car to work, she was hit by a truck and broke her arm. She can now claim her insurance company.

They’ll review her claim and, if it’s approved, they’ll help cover some of the costs associated with her injury, like medical bills and any other expenses she might have because of the accident. This can provide financial support during a challenging time and help ease the burden of unexpected costs related to the accident.

What are the Challenges Faced by Personal Accident Cover Holders?

Accident benefit insurance offers a safety net for financial protection during unexpected injuries. But for holders in Canada, there are hurdles to overcome. Let’s explore these challenges and find simple solutions.

- Medical Declines: Insurance companies providing accident cover sometimes choose not to cover people with pre-existing medical or health issues. This can leave individuals stuck without the necessary protection.

Solution: Look for insurance companies that specialize in covering people with medical conditions. They can provide the programs you need. You can also explore other forms of insurance, such as critical illness coverage, for added protection.

- Residency and Travel Issues: If you travel a lot or live abroad, it can be difficult to find accident benefit insurance that will cover you everywhere. This exposes you to risks when you are away from home.

Solution: Look for insurance companies that offer international coverage. Make sure your policy has provisions to keep its policyholders safe wherever they go.

- High-Limit Disability Issues: Disability coverage is supposed to help when you are unable to work due to an accidental injury. But sometimes the coverage limits aren’t high enough, leaving you in a tight spot financially.

Solution: Look for insurance policies with higher disability limits. Also, consider ways to increase coverage if necessary or consider adding additional funds through program riders.

- Specialized Industries/Unique Jobs: Some industries or jobs are risky, such as working in construction sites, mining jobs, and so on. It becomes difficult for individuals to get affordable insurance. This further makes people feel insecure in their working environment.

Solution: Find out the premiums of insurance companies that specialize in specific occupational hazards. They can provide accident benefit insurance tailored to your working environment, as well as safety features to help minimize workplace hazards.

- Balancing Pricing and Benefits: Balancing pricing and benefits in personal accident cover for Canadians is tough because everyone’s healthcare needs and risks can be different.

As a policyholder, it can become hard to manage your budget and make sure your insurance is profitable. You have to weigh things like how much you pay for premiums, how much coverage you get, and how high your deductibles are.

Solution: Look into all the different insurance options available, compare what they offer, and see how much they cost. You need to make sure the coverage matches what you’re comfortable with and what you can afford. It’s also important to review your insurance regularly and make changes if your situation or the market changes.

- Complex Policy Terms: Understanding the terms and conditions of personal accident covers can be challenging, especially for those without a background in insurance.

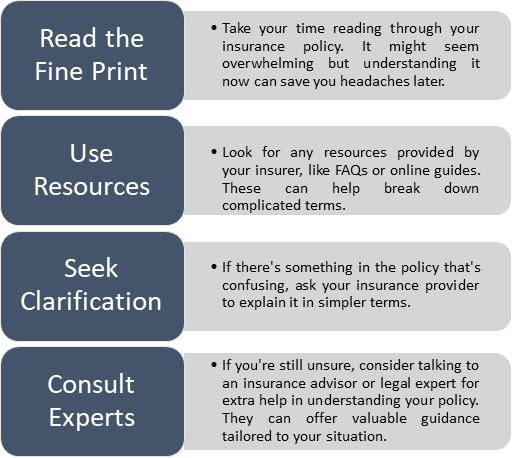

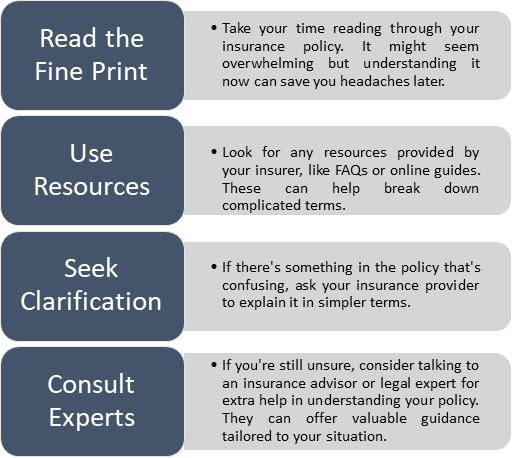

Solution: Policyholders can overcome the challenge of complex policy terms by taking the following steps:

- Delay in Claim Processing: Even when claims are valid, the processing time can be lengthy. Delays in receiving compensation can add financial strain, especially if the policyholder is unable to work due to their injuries.

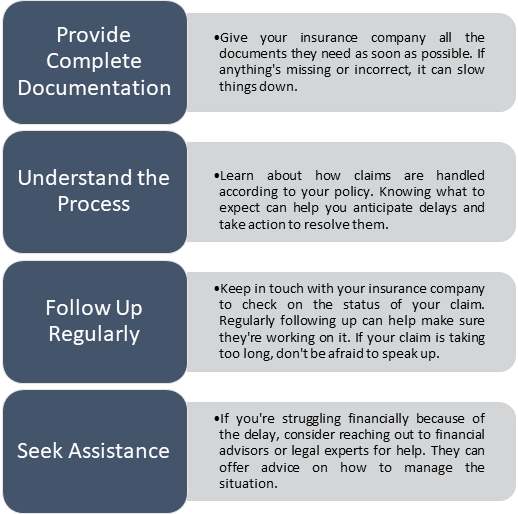

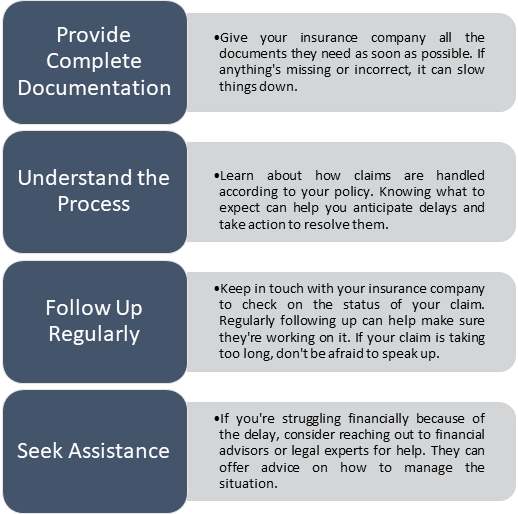

Solution: They can take the following steps to reduce the financial strain and quicken up the claim process:

Conclusion Points

In short, dealing with personal accident cover challenges in Canada is normal and manageable. Understanding policy terms, staying active with claims, and checking out other coverage options can keep finances safe.

The future promises transparent policies and smoother processes for better insurance management. With knowledge and action, Canadians can handle the hurdles of accident benefit insurance and get the right protection.

People Also Ask

Question: How long does it usually take for my accident insurance claim to get sorted in Canada?

Answer: It can vary. It might take a few days to a few weeks for them to process it, depending on how complicated it is, how busy they are, and if you’ve given them all the info they need.

Question: Can I make my accident benefit insurance cover more things if I want to?

Answer: Yes! You can add more coverage or upgrade your policy if you need to. Just remember, it might mean you have to pay more every month, so think about whether it’s worth it for you.

Question: Why do some jobs in Canada have higher personal accident cover costs?

Answer: Jobs like construction or mining can be riskier, so insurance companies charge more to cover them. They figure out the cost based on how likely accidents are in that job.

Question: Are there any things my accident insurance in Canada won’t cover?

Answer: Yes, certain activities or health conditions might not be covered. Make sure to read your policy carefully to know what’s included.

Question: Can I cancel my accident cover in Canada if I don’t need it anymore?

Answer: Sure thing! You can cancel it whenever you want by telling your insurance company. Just check if there are any fees for canceling first.

Question: How do I know if my accident insurance is good enough for me?

Answer: Keep an eye on your coverage limits, what’s excluded, and how much you pay. If you’re not sure, talk to someone who knows about insurance to help you figure out if it’s right for you.

Question: How much is the coverage limit for a personal accident cover in Canada?

Answer: The coverage for personal accident insurance may range from $25,000 to $750,000 per person. However, these rates are subject to change.