Which Real-Life Incidents are Protected by Best Renters Insurance?

Ever wondered what would happen if your apartment suddenly caught fire or flooded due to a neighbor’s fault?

Life can throw us unexpected curveballs and being prepared for them is key. That’s where the best renters insurance comes in. It’s like a superhero that protects tenants who live in rented places.

Let’s explore how this insurance protects your belongings from risks and why it’s important to have peace of mind in an unpredictable world.

What’s Renters Insurance?

Before diving into the protection renters insurance offers, let’s clarify what it is.

Renters insurance is a tenant insurance that is specifically designed to safeguard your personal belongings and provide liability coverage in case someone is injured while on your rented property. It’s typically affordable, offering peace of mind without breaking your bank.

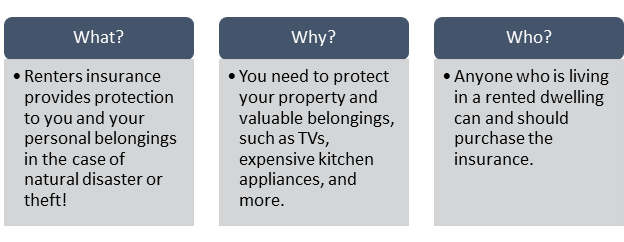

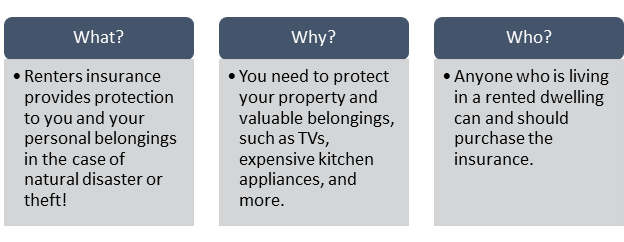

Best Renters Insurance: What, Why, and Who?

How Does a Best Renters Insurance Work?

The best renters insurance works to provide financial protection to tenants in the event of covered loss or damage. Here’s a simple real-life example to explain how it works:

Let’s say you are living on a rent and you have renters insurance. One day, while you’re at work, there’s a burglary, and several valuables are stolen, including your laptop, television, and jewelry. You come home and feel bad to find that your belongings are gone.

In that case, you would contact your insurance company and file a theft claim. You will need to provide details of the theft, such as the date, time, and description of the items stolen. Your insurance company will then review your claim and, if approved, offer compensation to replace the stolen items.

The compensation you receive will depend on the coverage limits and deductibles specified in your insurance policy. For example, if your claim has $10,000 personal items allowance and a $500 deductible, and the value of the stolen items is $5,000, you’d be eligible for $4,500 ($5,000 minus a $500 deductible).

What are the Real-Life Situations Covered by the Best Renters Insurance?

Here are some of the most common real-life situations covered by the best renters insurance:

- Stolen Phone: Your smartphone is an important tool that keeps you connected to the world. Unfortunately, theft can occur, causing you to lose access to this valuable equipment.

However, with expensive or cheap renters insurance, you can take comfort that you don’t have to waste your savings instead. It provides coverage for a stolen phone, ensuring that you can get a replacement without facing a huge financial burden.

- Stolen Bike: Losing your bike can be a huge setback, whether it’s your primary mode of transportation or a source of fun and exercise. Renters insurance recognizes the importance of your bike. It takes steps to reduce the financial burden of replacing it or buying a new one.

This means you won’t have to worry about the emerging unexpected cost. With the best renters insurance, you can soon be back on two wheels and still enjoy the benefits and freedom your bike offers.

- Stolen Laptop: Your laptop is not just a gadget; it holds your work, hobbies, and precious memories. Once stolen or damaged, the loss can be devastating.

However, with renters or apartment insurance, you can recover from the theft of your laptop with less financial stress. This coverage allows you to get back to your important files, continue working, and protect your valuable digital assets.

- Plumbing Leaks, Damaging Your Stuff: Imagine returning home to find your belongings soaked due to a plumbing leak. The cost of repairing or replacing water-damaged items can be unexpectedly high.

However, tenant insurance covers the costs associated with fixing or replacing your belongings damaged by plumbing leaks. This coverage spares you from the financial burden of sudden expenses, allowing you to recover and restore your belongings without worry. Whether it’s furniture, electronics, or personal items, the best renters insurance provides the necessary financial assistance to help you get back on track.

- Apartment or House Fire: A fire can be extremely dangerous, leaving you with a place to call home and destroying your personal belongings. To combat this, you can purchase any cheap renters insurance. It provides financial assistance to recover after a fire in a budget-friendly manner.

It covers the costs of rebuilding or finding alternative accommodation and ensures you keep your head up during the tough times. Plus, it covers damages, allowing you to replace them without all the financial burden.

- The Apartment Flooded Because a Neighbor Turned on Faucet: It is frustrating when your apartment is damaged by other people’s actions. If a neighbor causes flooding in a building, renters insurance can reduce the financial burden on you.

Whether it’s water damage to your furniture, electronics, or personal belongings, it provides the coverage needed to repair or replace affected items. Ultimately, this gives you peace of mind and protects your financial stability.

- Your Neighbor’s Apartment Catches Fire, Forcing You to Move: Sometimes circumstances beyond your control can ruin your living situation. If your neighbor’s apartment catches on fire, and you’re forced to move, choosing any cheap renters insurance could be your savior.

It covers temporary accommodation at such events. With the financial support of mortgage insureds, you can focus on stability and rebuilding without the added stress of finding housing immediately.

Final Thoughts: Best Renters Insurance

The best renters insurance is like a safety net for your belongings. It helps you if something bad happens, such as your belongings being stolen or your place damaged by an accident or disaster.

It may be cheap or not, but it can save you a lot of money and stress when things go wrong. So, don’t wait until it’s too late; get renters insurance now to give you peace of mind and protect your belongings.

People Also Ask

Q1. Do I need renters insurance in Canada?

While not mandatory, cheap renters insurance is highly recommended in Canada. It can save you a lot of money and stress if something unexpected happens to your property or rental property.

Q2. How much does claims insurance cost in Canada?

The cost of renters insurance in Canada varies depending on factors such as your property prices, location, and optional limits. The average price is quite expensive, usually costing just a few dollars per month. In case your budget is tight, you can choose from a cheap renters insurance list.

Q3. Can I get renters insurance in Canada if I rent someone else’s house?

Yes, you can still get renters insurance in Canada if you rent in someone else’s home. Even if you’re not renting an apartment or an entire house, it’s important to protect your belongings.

Q4. Does renters insurance in Canada cover my roommate’s furniture?

No. Generally, renters insurance only covers your personal belongings. If your roommate wants to be covered, they need to get their own renters insurance policy.

Q5. What happens if I accidentally damage my rental property in Canada?

If you accidentally damage your rental property in Canada, your best renters insurance can help cover the cost of repairs. However, it is important to examine your policy to ensure that you have identified specific terms and limitations.

Q6. How do I file for renters insurance in Canada?

If you need to file for renters insurance in Canada, contact your insurance agent as soon as possible. You will be guided through the process, which usually involves a written record of the transaction and an appraisal of your damaged or stolen items.