What’s No-Frill Car Insurance? Everything You Need to Know!

Paying big bucks for car insurance with much extra coverage can be frustrating. But what if you could get a simpler, cheaper option that still gives you the protection you need?

Sounds pretty good, right?

Traditional policies are comprehensive and expensive but Canadian drivers have another option: No-Frill Car Insurance. In this post, we will explore what it is, its benefits, and if it’s worth it. Also, we will cover what to consider before choosing any no-frill car insurance in Canada.

What’s No-Frill Car Insurance?

No-frills options have become popular as people seek affordable deals. This trend started in grocery stores with generic brands being cheaper. Now, it’s everywhere, even in insurance. For example, with car insurance, you might just want basic coverage to replace your car, not extras like rental car fees.

So, no-frill car insurance is like basic car insurance – it gives you the essential protection you need but costs less. ‘No-frills’ means plain and simple, without any extras. It’s all about meeting the minimum legal requirements and keeping costs down. These policies usually just cover the basics like paying for damage and injuries you cause to others in an accident.

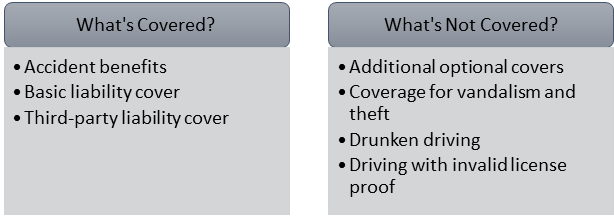

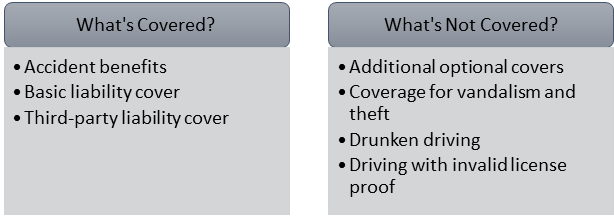

What’s Covered and Not Covered under No-Frills Car Insurance?

No-Frills Car Insurance Vs. Comprehensive Car Insurance: What’s the Difference?

| Feature | No-Frills Car Insurance | Basic Car Insurance |

| Coverage | Provides minimal coverage required by law, typically liability coverage for bodily injury and property damage. | Offers broader coverage options, including liability, collision, and comprehensive coverage. |

| Cost | Generally has lower premiums due to limited coverage. | Premiums may be higher as they offer more extensive coverage options. |

| Protection for Vehicle | Limited protection for your own vehicle; usually does not include coverage for theft, vandalism, or weather-related damage. | Offers comprehensive coverage for your vehicle, protecting against a wide range of risks, including theft, vandalism, and natural disasters. |

| Flexibility | Provides limited flexibility in terms of coverage options and customization. | Offers greater flexibility with various coverage options and customizable policy features. |

What are the Benefits and Features of No-Frills Car Insurance?

Let’s explore some of the key benefits and features of no-frills car insurance, highlighting suitability for different drivers.

- Simplified Coverage Options

Unlike traditional comprehensive car insurance, no-frills car insurance offers only basic coverage. It simplifies the decision-making process without any additional frills. This simplified approach makes it easier for drivers to understand their plans and choose the right coverage for their needs

- Affordability

The insurance is known for its low cost. By excluding options such as additional coverage, these policies typically result in lower premiums.

This affordability allows drivers to maintain adequate insurance without breaking their budget. By reducing insurance premiums, drivers can invest in other important expenses, creating financial stability and peace of mind.

- Flexibility

Though no-frills car insurance doesn’t offer wider flexibility, it at least allows customers to choose their coverage limits. Drivers have the right to choose the amount of coverage based on their specific needs and budget constraints. This flexibility empowers drivers to align their insurance policies with their individual circumstances, ensuring they get the right coverage without paying unnecessary fees.

- Meeting Legal Requirements

This type of car insurance is great because it helps you meet the minimum legal requirements set by the government. These policies give you the basic coverage you need to drive legally without paying for extra stuff you might not need. So, you can hit the road knowing you’re covered and following the law.

- Accessible for High-Risk Drivers

If you’ve had accidents or tickets in the past, getting affordable insurance can be tough. No-frills car insurance is a good choice for high-risk drivers because it offers basic coverage at good prices. It lets you meet legal rules without breaking the bank.

What to Consider Before Choosing a No-Frill Car Insurance in Canada?

Before choosing no-frill car insurance in Canada, remember the following points:

- Coverage Limits: Make sure the policy gives enough coverage to protect you if something happens. Check what your province says is the minimum you need. If you can afford it, think about getting more coverage to be safe.

- Deductibles: Think about how much you’ll have to pay if something goes wrong. The deductible is what you pay first before the insurance helps. If you’re okay with paying more at once, you can pay less each month. But remember, if something happens, you’ll have to pay more too.

- Exclusions and Limitations: Check what the policy doesn’t cover. Some things might not be included, like driving drunk or using your car for work. Make sure you understand what’s not covered so you’re not surprised later on.

- Premium Costs: When choosing a no-frills car insurance policy in Canada, it’s essential to think about how much it will cost you. Premiums, or the amount you pay for insurance, can be different depending on which company you choose.

It’s smart to compare prices from different insurers to find the best deal. But remember, it’s not just about finding the cheapest option. Make sure you’re still getting enough coverage to protect yourself if something happens.

- Customer Service: Look for insurers that have a reputation for being helpful and friendly. This can make a big difference if you ever need to ask questions, make changes to your policy, or file a claim. Good customer service can give you peace of mind knowing you’ll get the help you need when you need it.

Are No-Frill Car Insurance Worth It?

Deciding if no-frill car insurance is worth it depends on your situation. Here are things to think about:

- Financial Situation: If money is tight, no-frill insurance can help. It gives you what you need to follow the law without breaking the bank.

- Vehicle Value: If your car isn’t worth a lot, you might not need extra-coverage insurance. No-frill insurance can be good for older or cheaper cars since it keeps costs down.

- Risk Tolerance: No-frill insurance mostly covers damage you cause to others. If you’re okay with fixing your own car, it could work. But if you want more coverage for your car, you might need something else.

- Driving Habits: If you’re a careful driver with a clean record, no-frill car insurance could be fine. But if you’ve had accidents or tickets, you might need more coverage.

The Bottom Lines: No-Frills Car Insurance

To sum up, no-frills car insurance is a simpler, budget-friendly option for Canadian drivers. It may lack some extras of traditional comprehensive car insurance, but still gives essential protection.

It’s better to understand its features, benefits, and your needs to decide if it’s right for you. Do your research to find the balance between coverage and affordability.

People Also Ask

Q1. Will my no-frills car insurance premiums increase after an accident?

Depending on your insurer and policy terms, your premiums may increase after an accident, even with no-frills car insurance. It’s essential to review your policy details and potential rate changes carefully.

Q2. Is the insurance available in all provinces in Canada?

No-frills car insurance is typically available in almost all provinces in Canada. However, coverage options and availability may vary depending on the insurance market and regulatory requirements in each province.

Q3. Does the car insurance offer roadside assistance?

No-frills car insurance policies generally do not include roadside assistance as a standard feature. However, some insurers may offer it as an optional add-on for an additional fee.

Q4. Will the insurance cover my medical expenses in an accident?

This type of car insurance typically includes liability coverage for bodily injury to others. It may not cover your own medical expenses in an accident.

Q5. Can I cancel my no-frills car insurance policy anytime?

The majority of companies allow policyholders to cancel their coverage at any time. However, you may be subject to cancellation fees or penalties, so it’s essential to check your policy terms.