What are the Emerging Trends in Comprehensive Car Insurance?

“Your car is more than just metal and wheels – it’s your faithful companion on the road. And comprehensive car insurance protects that companion!”

But have you ever wondered how your comprehensive car insurance might adapt to the changing times? What if it could predict your needs before you even hit the road?

In today’s tech-driven world, with electric cars quietly gliding through Toronto streets, the future of car insurance is on the brink of a major transformation. In this post, we will explore how the world of car insurance will transform in the future of Toronto!

What’s Comprehensive Car Insurance?

Comprehensive vehicle insurance acts as a safety net for your car. It helps cover the cost if something unexpected happens to your vehicle, such as damage from theft, vandalism, or natural disasters like hurricanes.

It’s an extra layer of protection beyond just covering accidents with other cars. So, if something happens to your car that isn’t your fault, comprehensive coverage can help pay for repairs or even replace your car altogether.

Here’s how comprehensive car insurance differs from basic car insurance!

| Aspects | Comprehensive Car Insurance | Basic Car Insurance |

| Coverage | Wider coverage to theft, weather, collisions, and more! | Covers only third-party losses. |

| Cost | Expensive because of wider coverage. | Affordable because of lower coverage. |

| Requirement | Often required for all-inclusive protection. | Required and mandated by the law. |

| Customization Options | Wider Range | Limited |

| Additional Benefits | Wider Range | Limited |

What are the Future Trends of Comprehensive Car Insurance in Canada?

Here are the following trends that are boldly reshaping the landscape of comprehensive auto insurance in Canada:

- Telematics & UBI-Based Insurance Policy

Telematics is changing the game in car insurance, using advanced technology to make things better for drivers.

Imagine your car like a smart friend, silently sending information to your comprehensive vehicle insurance company about how you drive and the condition of your vehicle. It goes beyond counting miles or tracking your location; it can tell if you’re driving safely, remind you to buckle up, or even warn about potential collisions.

And here’s the best part: with telematics, more and more insurance companies will offer Usage-Based Insurance (UBI) in the future. It means your premium will not be based on guesswork or averages; it will be tailored to how you drive. So, if you’re a safe driver, you could save some significant money. It’s like getting rewarded for being responsible behind the wheel!

- Increased Use of AI Tools

AI is also shaking things up in comprehensive coverage of cars. It’s making things faster, more accurate, and better for customers. And as this technology keeps growing, who knows what else it’ll do to make insurance even smoother in the future?

Let’s take the example of Mr. William, a driver from Toronto. Earlier when he got into a minor accident, dealing with insurance used to be a headache. But with AI, things become uncommon.

As soon as Mr. Williams reports the accident, the AI tools get to work. They analyse his driving history, the accident time and place, and even the weather at the time. This helps the insurance company to quickly decide if the claim is valid or not, or how much damage was done.

Now, let’s talk about settling the claim.

Instead of waiting weeks for answers, Mr. William hears back from his comprehensive auto insurance company fast. AI systems estimate repair costs accurately and coordinate with repair shops, making the process smoother and quicker.

Moreover, there is no need to wait on hold for hours. AI-powered chatbots are available 24/7 to help customers like Mr. William. They answer questions, guide customers through the claims process, and even suggest personalized insurance options.

- Elevated Focus on Cybersecurity

Cybersecurity for Canadian businesses, including insurance companies, is quite challenging. In 2020, 78% of Canadian companies faced cyberattacks, and in the following year, it rose to 85.7%, showing a concerning issue.

And as cars are becoming more connected with internet features, they also open unexpected risks for cyber threats. To tackle these risks, comprehensive vehicle insurance companies are stepping up. They’re now offering cybersecurity insurance specially designed for connected cars.

If your car gets hit by a cyber-attack, this insurance can cover the costs of fixing it, recovering data, or even covering damages if someone else is affected.

- Redefining Liability in Autonomous Driving

Autonomous driving, or cars that can drive themselves, might change the way comprehensive vehicle insurance works. Why? Because these cars are designed to have fewer accidents, making them safer overall. This means insurance could focus more on predicting and preventing accidents rather than just covering the costs afterward.

For example, if today you get in a car accident, it’s usually your fault or the fault of another driver. But with autonomous cars, the responsibility for accidents might shift from human drivers to the companies that make the self-driving technology. These companies would be responsible for making sure their technology works safely and doesn’t cause accidents.

This shift in responsibility could mean big changes for the comprehensive car insurance industry. Instead of just paying for accidents, insurance companies might start focusing more on preventing them in the first place. They could work with the companies that make autonomous technology to make sure it’s safe.

- Higher Flexibility and Affordability

Canadian consumers are keen on having control over their comprehensive auto insurance, with 61% showing strong interest in customizable options. Despite this demand, flexible insurance isn’t widely available yet.

During the pandemic, people’s routines changed a lot, leading to a greater need for adaptable insurance. With uncertainties about work and lifestyle, Canadians want the flexibility to adjust their coverage based on how much they’re using their car.

The economic impact of the pandemic also made people more conscious of their spending. Many Canadians are looking for ways to save money, including on their comprehensive auto insurance. They value being able to change their coverage to match their financial situation.

Thus, insurance companies will meet the flexibility and affordability demands of Canadians in the future. By doing so, they will not only satisfy their customers but also stay ahead of their competitors.

- Rise of Various Players

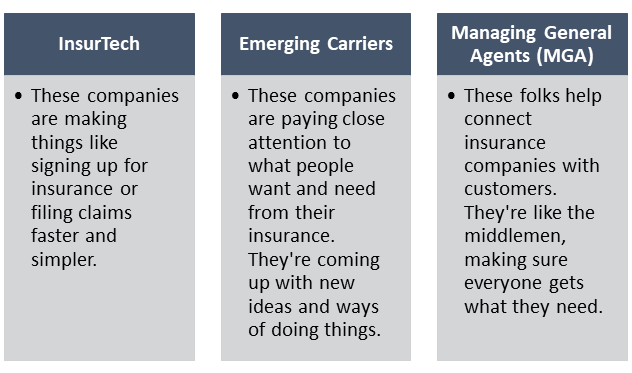

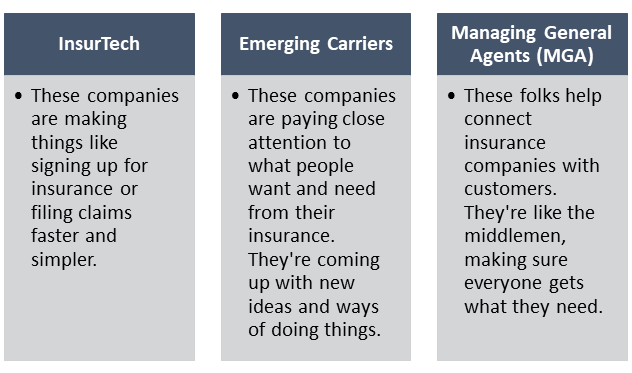

In the world of insurance today, different groups are emerging and working to make things better. They are as discussed below:

So, in the future, these 3 players will have more opportunities in the comprehensive car insurance sector.

Conclusion Points: What Future Does Comprehensive Car Insurance Hold?

In conclusion, car insurance in Canada is changing for the better. New technologies like telematics and AI, along with affordable coverage options, are making insurance safer and more convenient.

Insurers prioritize keeping up with evolving needs, with a focus on cybersecurity and the upcoming era of autonomous driving. As we look ahead, the future of comprehensive car insurance promises to be safer, more efficient, and easier for drivers across the country.

People Also Ask

Q1. Do I need comprehensive car insurance if I already have basic coverage?

Basic coverage might be enough for some, but comprehensive auto insurance gives extra protection from more risks. It’s good for those wanting all-inclusive coverage for their cars.

Q2. Are there any things not covered by comprehensive car insurance?

Some policies don’t cover things like wear and tear, mechanical problems, or damage from purposeful harm or illegal activities.

Q3. Can I add extra benefits to my full-coverage car insurance?

Yes! Many insurers let you add things like roadside help, rental car coverage, or glass protection to your comprehensive plan for more safety.

Q4. How do insurance companies figure out how much I pay for my comprehensive car insurance?

They look at factors like ‘how you drive’, ‘what type of car you have’, ‘where you live’, and ‘how much coverage you want’ to decide your premium.

Q5. Can I make more than one claim with my all-inclusive car insurance in a year?

Usually, yes, but making lots of claims could make your future premiums higher.