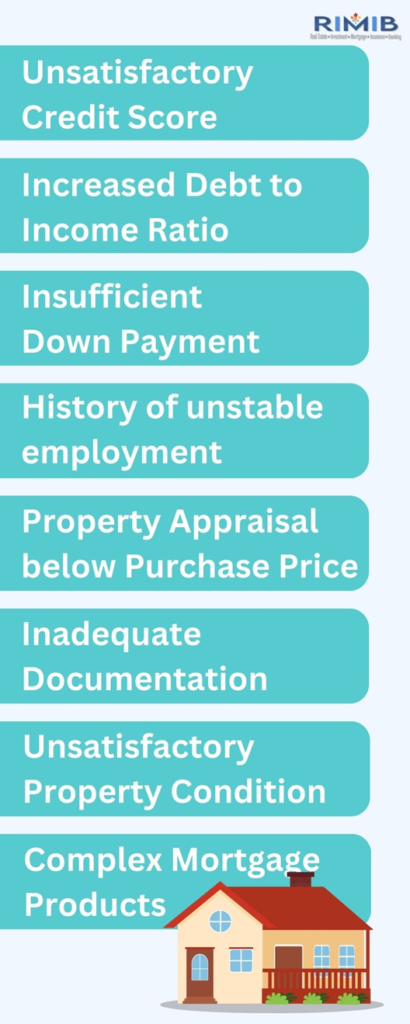

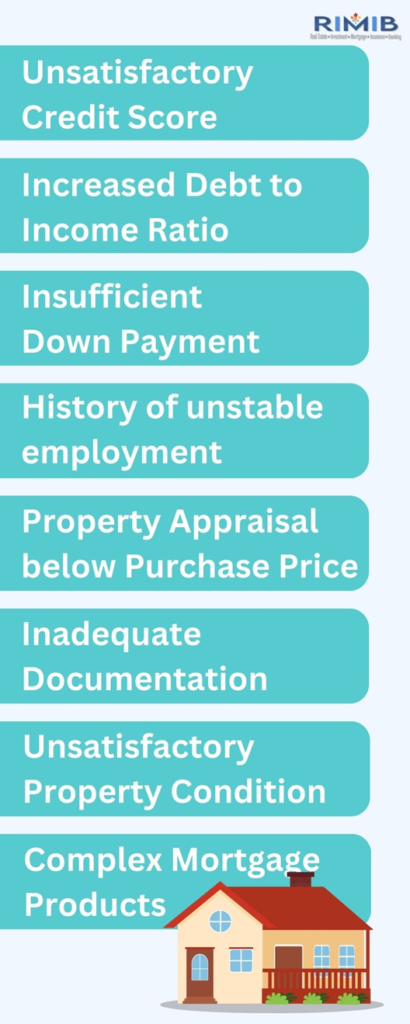

Mortgage Approval Roadblocks: How Banking Professionals Can Guide GTA Homebuyers

It may be thrilling and difficult to buy a house in the Greater Toronto Area (GTA), particularly when it comes to negotiating the mortgage approval process. Although purchasing a home is an important life milestone, there may be possible obstacles that prevent a smooth mortgage approval. In order to help GTA homebuyers overcome these challenges and make sure that their journey to homeownership goes more smoothly, banking experts play a critical role. This article explores the typical obstacles to mortgage approval that GTA homebuyers encounter and offers advice from banking specialists on how to get through them.

Unsatisfactory Credit Score

To obtain advantageous mortgage conditions, you must have a high credit score.

Having a credit score that is below what lenders want is a problem for many GTA homeowners. Banking experts may assist by offering guidance on raising credit scores, including timely bill payment, debt reduction, and avoiding new credit inquiries.

Expert Guidance: Before submitting a mortgage application, banking experts may study credit reports with homeowners to pinpoint areas that need improvement and create a strategy to raise their credit score.

Increased Debt to Income Ratio

Lenders look at the debt-to-income ratio (DTI) to assess a borrower’s capacity for handling both their mortgage and other obligations.

- A high DTI may make it difficult to have a mortgage approved.

- Banking experts can assess a house buyer’s financial status and offer solutions to lower debt or boost income to satisfy the requirements of lenders.

- Banking experts may compute DTI ratios, provide perceptions into allowable thresholds, and provide advice on debt restructuring to reach a more favorable DTI.

Insufficient Down Payment

Saving enough money for a sizable down payment can be difficult, especially in a costly location like the GTA. Homebuyers who struggle to make the required minimum down payment may have trouble getting their mortgage approved. A smaller down payment for a home can be made possible by government programs and alternative down payment options that banking experts can present.

Expert Guidance: Bankers may inform prospective homeowners about possibilities including the First-Time Home Buyer Incentive and tax-free withdrawals from Registered Retirement Savings Plans (RRSPs) for down payments.

History Of Unstable Employment

A solid job history is important for getting a mortgage. Those who are self-employed and those with erratic employment histories may encounter difficulties in this regard. Banking experts can help by outlining paperwork needs and recommending actions to show a steady income to leaders. Banking professionals can guide homebuyers on providing necessary proof of income, showcasing a reliable work history, and discussing alternative documentation methods for self-employed applicants.

Property Appraisal Below Purchase Price

Property appraisals that come in lower than the purchase price can lead to financing issues. In such cases, homebuyers might need to come up with additional funds to cover the shortfall. Banking professionals can explain the options available to address this situation and potentially renegotiate the purchase price.

Expert Guidance: Banking professionals can work with appraisers, provide guidance on negotiating with sellers, and explore options like appealing the appraisal or reassessing the home’s value.

Inadequate Documentation

Mortgage applications require extensive documentation to verify financial information. Missing or incomplete documents can lead to delays or denials. Banking professionals can help homebuyers prepare a comprehensive package, ensuring all necessary documents are submitted accurately and on time.

Expert Guidance: Banking professionals can provide a checklist of required documents, assist in obtaining proof of income and assets, and ensure all paperwork is organized for the application process.

Unsatisfactory Property Condition

Lenders often require property inspections to assess its condition and value. If issues arise during the inspection, it might affect mortgage approval. Banking professionals can offer guidance on addressing property concerns, securing necessary repairs, and liaising with the lender to ensure the property meets their requirements.

Expert Guidance: Banking professionals can recommend qualified inspectors, review inspection reports with homebuyers, and collaborate with appraisers to address property-related concerns.

Complex Mortgage Products

GTA homebuyers might be interested in exploring various mortgage products, each with its terms and conditions. Some mortgage products might be better suited to their financial situation and goals than others. Banking professionals can simplify the complex array of options, providing insights into fixed-rate, variable-rate, and hybrid mortgages.

Expert Guidance: Banking professionals can explain the features and risks of different mortgage products, helping homebuyers choose the one that aligns with their financial preferences and long-term plans.

Navigating the mortgage approval process in the GTA can be daunting, but with the expertise of banking professionals, homebuyers can overcome the roadblocks that often arise. From credit score improvements to addressing property concerns, banking professionals play a pivotal role in guiding homebuyers toward successful mortgage approvals. By providing expert guidance, insightful advice, and personalized solutions, banking professionals ensure that GTA residents can confidently achieve their dream of homeownership in one of Canada’s most vibrant and competitive housing markets.