How Does Credit Card Minimum Payments Work? Learn With Real Examples

The Minimum Payment of a credit card refers to the payment of the amount required to clear your credit card debt without attracting penalties. A user that only pays the minimum balance feels convenient while doing this but cannot foresee the troubles that can occur in the future.

Making a minimum payment stretches your debt longer and impacts your credit rating. Every coin is two-faced, and the same is in this situation.

- Only making minimum payments allows you to save cash for financial emergencies.

- No matter how small you save each month, it will eventually help you.

- It is good in a short-term strategy but will trouble you in the longer run.

- It can help you avoid penalties but will help you only a bit while reducing your credit card debt.

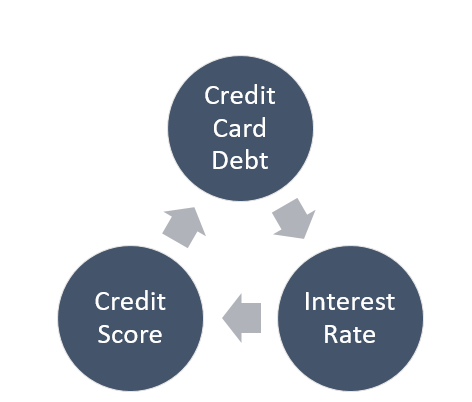

Credit Card Minimum Payment Meaning

Credits: Pixabay

It is the minimum payment you pay for running your credit card smoothly.

- It is the smallest amount you can pay to your lender, failing to do so attracts a penalty that will add up to the loan amount you have secured.

- There are also cases where lenders increase the interest rate if you fail to make this minimum payment.

How To Calculate Minimum Payments Of A Credit Card?

Credits: Pixabay

There is no rocket science associated with how to calculate the minimum payments for a credit card. In some cases, a fixed percentage (usually 1% – 3%) or a fixed amount (generally $10) needs to be paid by the borrower, failing to do so, the borrower must bear a penalty imposed for late payment.

Suppose Josh has a credit card balance of $5000 and the interest percentage is 3% he has to pay $150 (3% of $5000) + late fees(if the balance is paid late).

Information For Minimum Payment Users

Suppose Josh has a $5000 credit card balance with a 20% interest rate with a minimum percentage rate of 3% or $10 (the higher one is chosen).

According to the Government of Canada’s credit repayment calculator, there are two ideal payment schedules.

If You Pay The Minimum Amount Only

- Time for paying the balance off: 20 years, 11 months

- Interest paid (Total): %5,991

- Total payment: $10,991

The Schedule: If You Add $50 To Your Minimum Payment Amount

The value of $50 on the monthly minimum payment amount may not seem a huge deal in the short time but affects the schedule heavily.

- Time for paying the balance off: 5 years, 3 months

- Interest paid (Total): $2,304

- Total payment: $7,304

Paying A Fixed Amount Monthly

Suppose Josh pays $200 (fixed amount) monthly for his remaining dues ($5000).

- Time for paying the balance off: 2 years, 9 months

- Interest paid (Total): $1,522

- Total payment: $6,552

Always Remember

Do you notice the difference in each scenario? It implies that adding whatever you can ($50 minimum) to the minimum payment amount that you pay monthly or using a fixed amount ($200 in this case) drastically changes the time span to collapse your overall debt ($5000 in this case).

Reasons You Should Add More Amount To Your Monthly Payments

There are several financial encounters where you are only capable of making the minimum payment itself, this is acceptable as long as this doesn’t become habitual and you constantly suffer to make regular payments.

- The above conclusion (Three Time Schedules) is enough to make you understand this strategy.

- However, you must also know the following about paying more than just the minimum payment amount.

1. Your Credit Card Debt Collapses Early

The usual mentality of a credit card issuer is to allow you the minimum possible amount for paying back your credit card debt.

It is a convenient option for a borrower as you don’t have to pay an enormous amount to maintain your balance and attract a penalty.

However, this will only benefit you for a short time as it has adverse effects in the long run.

- No real progress is made in balance repayment by paying just the minimum payment amount.

- The more amount you pay monthly, the faster you will be able to repay your full debt and save the amount that you will lose if you only stick with the minimum payment amount strategy for convenience.

Taking the above conclusion, we find that if you pay the minimum payment amount every month (if you owe $5000), it takes approximately 21 years to repay your debt as opposed to 5 years, 3 months if you pay only $50 more, and 2 years 9 months, if you pay $200 monthly for a $5000 credit balance.

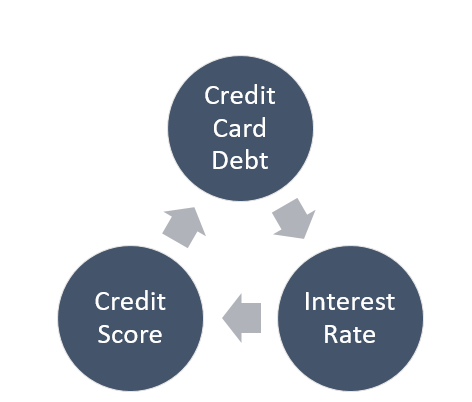

2. The Interest You Will Pay Will Be Enormous

No matter if you have a credit card with a low-interest rate, if you only pay the minimum payment amount, your interest will surge along with your balance.

Sticking only with the minimum payment amount will only allow you to clear the previous month’s interest, so if you pay with your card regularly, you will fall into a debt spiral.

3. Your Credit Score Suffers

The credit utilization ratio is inversely proportional to your credit card balance. If you have a huge balance, this ratio will decrease, and vice versa. This credit utilization ratio affects your credit score. Having a low credit score will make you lag financially in the future, so it must be high at all times.