Bank of Montreal Plus Account versus HSBC Premier Chequing Account – the best chequing from top banks

The Bank of Montreal Plus Account is a superior chequing account that allows you to do several banking transactions at a low cost. You can instantly open this account by clicking here.

The HSBC Premier Chequing Account gives premium services and priority support at zero monthly fees. Click here to open this account.

Let us compare these chequing accounts to figure out the perfect option for you.

1. Bank of Montreal Plus Account

WELCOME OFFER

Earn a welcome bonus of $100 when you open this chequing account.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Have a Canadian address. |

| c. | Be a major as per the age of majority set by your province. |

| d. | You must have your Social Insurance Number (SIN) |

Interest Rate

- This chequing account does not offer any interest

Minimum Balance

- There is no requirement for any minimum balance

Transactions

- You get 25 free banking transactions per month

- You can do unlimited Interac e-Transfer every month Monthly Fees:

- There is a monthly fee of $11.95

- However, you will get a waiver if you maintain a minimum balance of $3,000

Additional Benefits

2. HSBC Premier Chequing Account

The HSBC Premier Chequing Account gives you a premier status with a dedicated relationship manager. You can get insurance coverage and travel benefits.

WELCOME OFFER

You can earn up to $500 as an opening cash bonus. You can also enjoy $958 in cashback and savings.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | You must have attained the age of majority. |

| c. | Have any of the following documents: Passport Driver’s License or Provincial government Issued I.D. |

Interest Rate

- You do not get any interest in this chequing account

Minimum Balance

- There is no requirement for any minimum balance.

Transactions

- Unlimited debit transactions and Interac e-Transfer when you meet the eligibility criteria

Monthly Fees

- There is no monthly fee when you meet the eligibility criteria

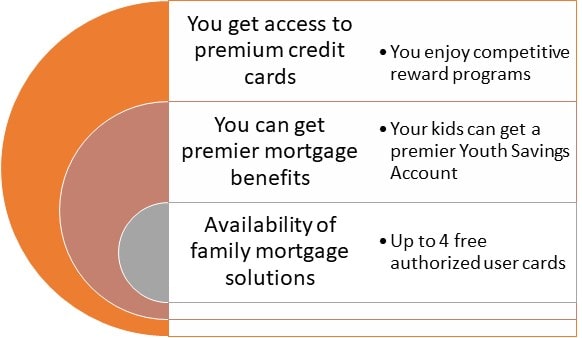

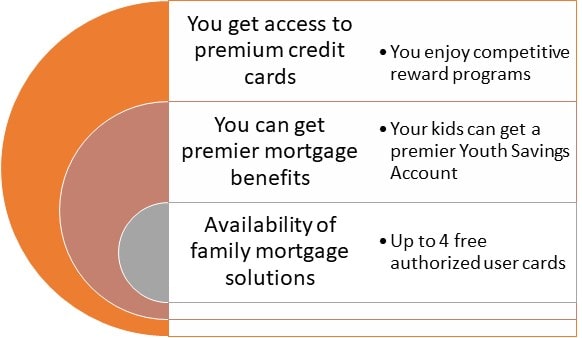

Additional Benefits

COMPARATIVE ANALYSIS

We compare the typical features of the accounts through a table.

| Parameters | Bank of Montreal Plus Account | HSBC Premier Chequing Account |

| Opening Cash Bonus | $100 | $500 |

| Monthly Fees | $11.95 | $0, if you meet the eligibility criteria |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Debit Transactions | 25 | Unlimited, if you meet the eligibility criteria |

Among the five parameters mentioned above, the Bank of Montreal Practical Account scores were higher in three. There is a tie in two parameters.

OPINION of Expertbyarea. money

If you meet the eligibility criteria set up by the HSBC Premier Chequing Account, you get access to unlimited banking at zero monthly fees. Also, you get a comparatively higher opening cash bonus with a cashback of up to $958.

However, the Bank of Montreal Plus Account can come to your rescue if you cannot satisfy the eligibility criteria. It offers you 25 monthly transactions at $11.95/month.

Evaluate your requirements. Choose the best account that better serves your needs.