Which one is for you – CIBC’s Everyday Chequing Account vs. Scotiabank Basic Bank Account

The CIBC Everyday Chequing Account is a basic banking account with a low monthly fee. It is perfect for those who do less banking.

We have a Scotiabank Basic Bank Account, which aims to cover your minimal financial needs. You can use it for daily banking needs such as purchases, ABM transactions, and payroll deposits.

Let us compare both chequing accounts and see the perfect option for banking.

COMPARATIVE ANALYSIS CIBC EVERYDAY & SCOTIABANK BASIC

| Parameters | CIBC Everyday Chequing Account | Scotiabank Basic Bank Account |

| Opening Cash Bonus | Not applicable | Not applicable |

| Monthly Fees | $4 | $3.95 |

| Interest Rates | 0.00% p.a. | 0.00% p.a. |

| Minimum Balance | Not applicable | Not applicable |

| Transactions: Banking Interac e-Transfer | 12 free, Additional – $1.25 per transaction Receiving free, sending- $1.50 per transaction | 12 free Free – Both receiving and sending |

1. CIBC Everyday Chequing Account

The CIBC Everyday Chequing Account allows you to use mobile banking or CIBC online. Using it, you can

- Transfer money

- Pay bills

- Make purchases

- Manage your money anywhere and from anytime

WELCOME OFFER

There is no welcome offer attached to this banking product.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Be a major as per the age of majority set by your province. |

- Interest Rate:

- This account does not offer any interest

- Minimum Balance:

- You are not required to maintain any minimum or daily balance

- Transactions:

| INTERAC e-Transfers | Banking Transactions* |

| You can receive the Interac e-Transfer for free | You are not required to pay anything for the first 12 monthly transactions. |

| However, you need to pay $1.50 for every outgoing Interac e-Transfer transaction | For every additional transaction, you will pay $1.25 per transaction |

* Bank counts the following transactions towards “Banking transactions”:

- Debit purchases

- CIBC withdrawals (including CIBC ATM)

- Transfers

- Cheques

- Pre-authorized payments

- Bill payments

- Monthly Fees:

- The monthly fee is $4

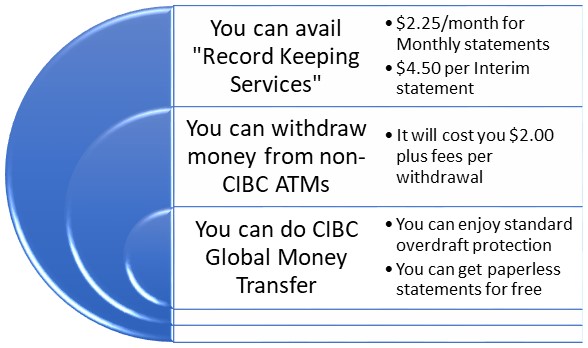

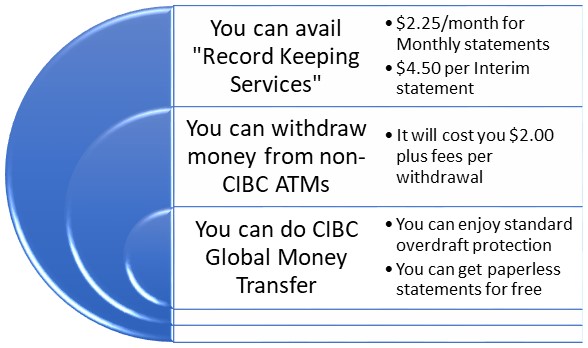

- Additional Benefits:

2. Scotiabank Basic Bank Account

MoneySense voted the Scotiabank Basic Bank Account the best basic banking account in 2020. You get the facility of checking your credit score for free, besides using Apple Pay, Samsung Pay, and Google Pay.

WELCOME OFFER

There is no welcome offer associated with this banking product.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Be a major as per the age of majority set by your province. |

- Interest Rate:

- This chequing account does not offer any interest rate

- Minimum Balance:

- You are not required to maintain any minimum balance

- Transactions:

- You get 12 free monthly transactions per month

- The Interac e-Transfer transactions are free

- Monthly Fees:

- The monthly fee is $3.95

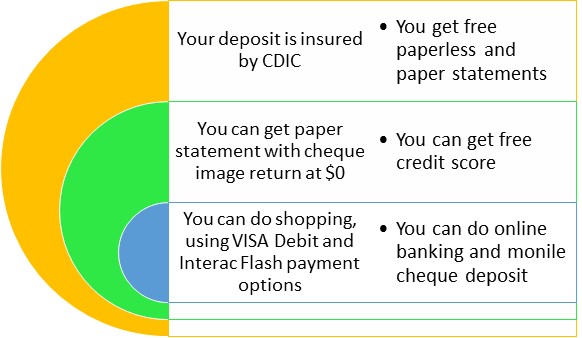

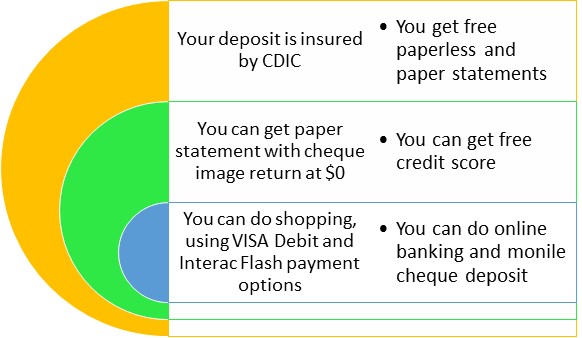

- Additional Benefits:

OPINION of Expertbyarea.money

Both the chequing accounts compared in this article serves your minimal banking needs. You can do transfers, cash withdrawals, and payroll deposits using them.

Both accounts are identical. However, the Scotiabank Basic Bank Account slightly scores higher for transactions. You get free Interac e-Transfer, both incoming and outgoing.

Evaluate your requirements. Choose the best account that better serves your needs.