Top Reasons Why Condo Insurance Is Rising?

Do you live under the threat that someone will steal your belongings from your condominium? Do you feel you might cause harm to Neighbour properties? Well, stress is the root cause of most problems. But you can certainly manage it by buying a personal condominium insurance policy. Let us explore more and understand why every Ontarian is after it.

What Is a Condo Insurance Policy?

You spend your next 20-25 years buying a home. And it can serve your generations to come.

Ask any Canadian, and they love their condominiums. Protecting its contents and assets is the number one priority for most of us.

It prompted the insurance companies to develop an entirely new optional insurance product, the “Condo Insurance.”

A condominium insurance policy protects you from financial losses by covering most of your assets and events related to your condominium.

What does Condo Insurance cover?

Below is a list of events covered by a typical condominium insurance policy:

| S. No. | Events | Explanation |

| 1. | Improvements | • A condo insurance policy covers all your expenses incurred in renovating or improving your condo, such as: a) Installation of new cabinets or countertops b) Replacing the damaged hardwood floor c) Applying new coverings on the walls, crown moldings, etc. • It must also be noted that there are a few condo corporations that will require you to do flooring and install countertops. • In such a situation, your condo insurance policy will help you to cover such expenses as well. • The coverage limit starts from around $2500 |

| 2. | Personal Property | • Be it your assets or any specialty property inside your condo, this policy covers it all. • The damages sustained by your furniture, clothes, electronic equipment, and other household assets are covered by the condo insurance policy • Theft, loss by fire, and damages due to natural calamities are some of the valid reasons covered under this policy • The coverage limit starts from around $20,000 and there is no upper limit |

| 3. | Third-Party Damages | • Imagine that one day you just rushed to your office and forgot to close your kitchen faucet • This led to excessive water damage to the families living under your unit and they sued you • A condo insurance policy protects you from all the third party damages and covers all such claims • Usually, the coverage for third party liabilities is between $500,000 and $3,000,000 |

| 4. | Your Private Locker | • The condo insurance policy considers your private locker as a part of your insured premises • Hence, in case anything is stolen from it, a condo insurance policy will always compensate you |

| 5. | Special Assessments | • It is common for the condo corporations to make assessments against the individual condo owners when there is a lack of money in the reserve fund • This largely happens when a single condo owner and his or her unit are responsible for damages and losses to the other units of the building • In such cases, you might be required to make good the losses sustained • A personal condo insurance policy can also cover all such special-assessment-losses protect you from steep financial losses |

| 6. | Additional Living Expenses | • At some point in time, your condo will undergo repairs, or maybe you can’t live in it simply because it has suffered damages • This will require you to live in some other accommodation and pay the daily rent. • A condo insurance policy covers this expense as well and protects you from the cost of temporary accommodation • The coverage limit for this type of claim usually starts from $10,000 |

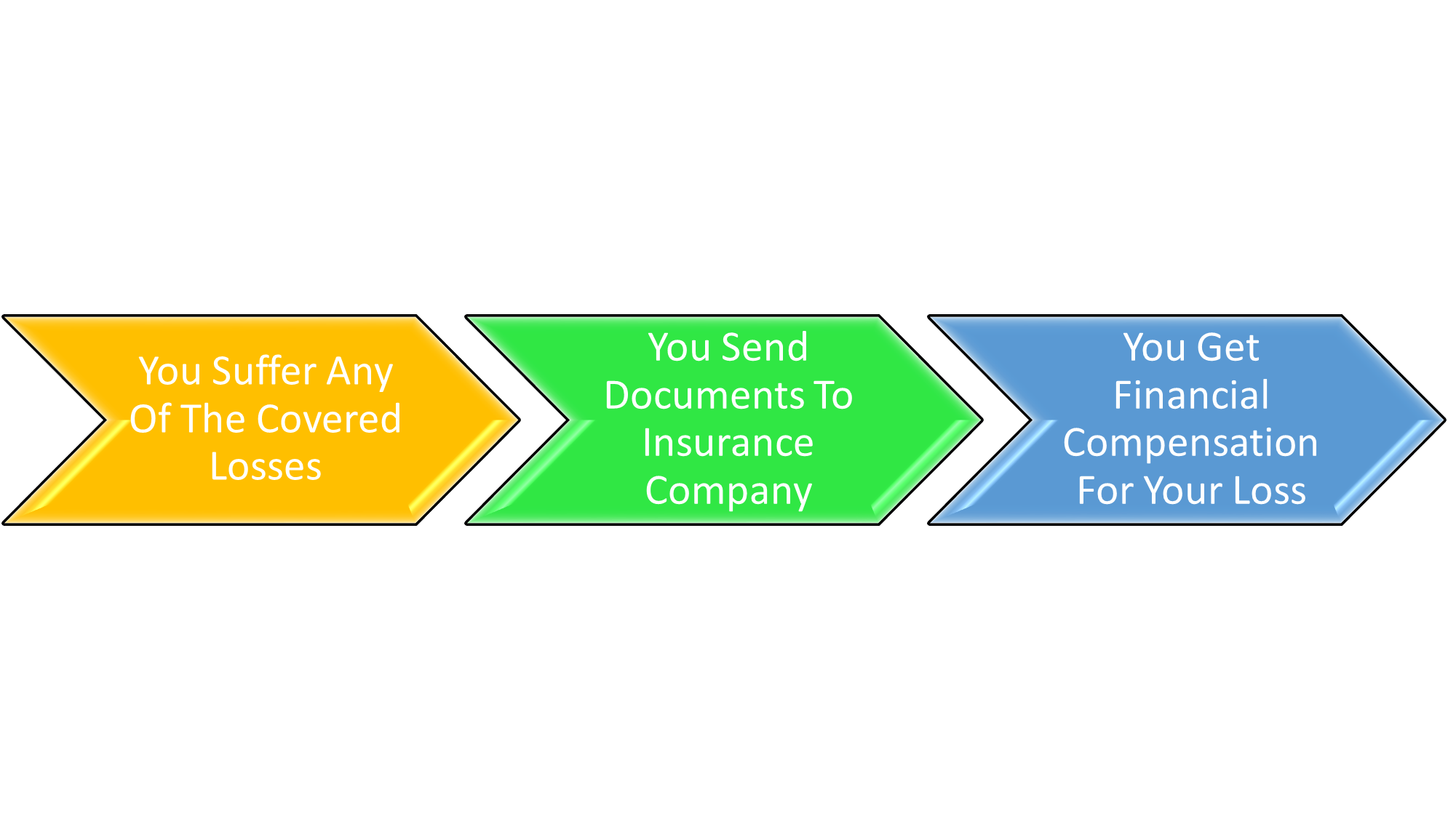

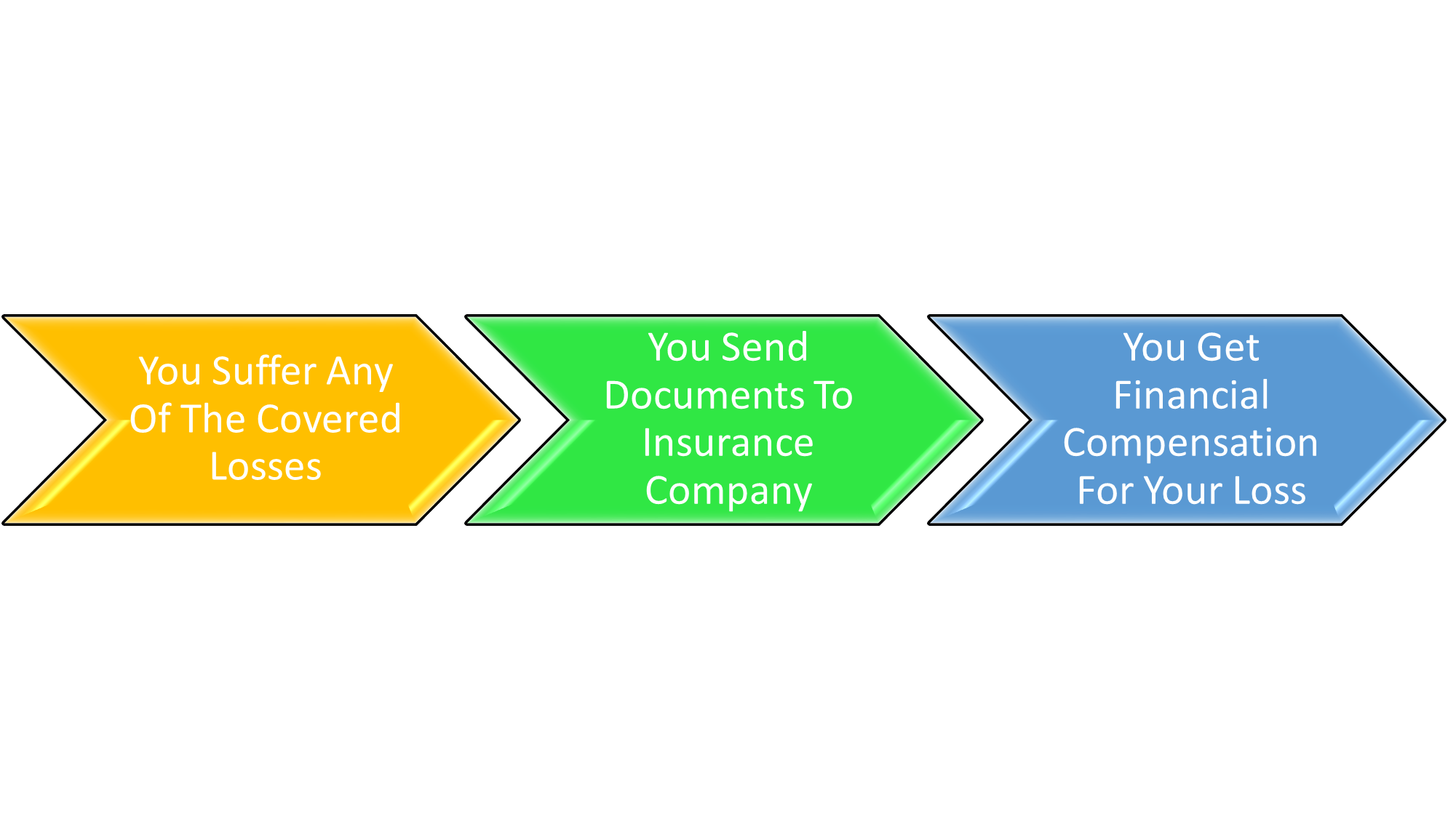

How Does Condo Insurance Work?

Let us understand this with the help of an example.

- Alex is a salaried professional. He has recently purchased a condominium in the Greater Toronto Area.

- One of his neighbors has advised him to buy out a personal condominium insurance policy to protect himself from unexpected financial losses.

- However, Alex decided not to buy the policy and thought it a waste of money.

- It was a Saturday, and Alex went out with his friends to have a late-night party.

- On the way home, some miscreants robbed Alex.

- He estimated the total loss of such theft was upward of $30,000.

| What If Alex Had a Condo Insurance Policy? | What Is Happening When He Did Not Have a Condo Insurance Policy? |

| • Subject to the coverage limit, Alex would have been compensated by the insurance company for the losses sustained by him • Upon producing relevant documents, he would have got the reimbursement for $30,000 | • Since Alex does not have any condo insurance policy, he cannot claim his losses from anywhere |

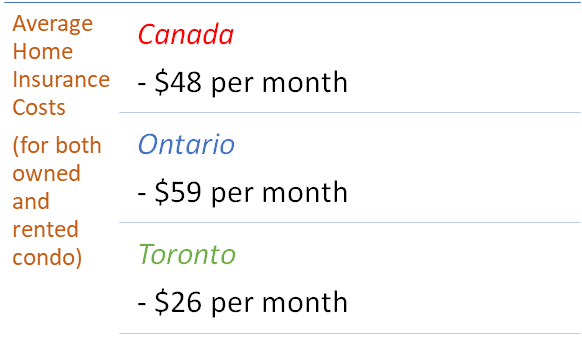

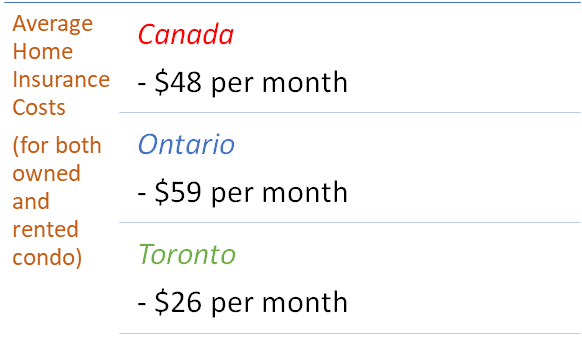

How Much Does a Condo Insurance Cost?

It certainly does not cost you a fortune. A condominium insurance policy gives you financial freedom at an affordable premium. Have a look at the cost of average insurance premiums