Challenges Faced by First-Time Buyers of Homes in Canada: How to Overcome Them?

Buying a home in Canada for the first time can be very hard. The housing market here is expensive, and prices keep going up. First-time buyers of homes face many problems like high costs, strict mortgage rules, and hidden fees.

Understanding these challenges is important so that new buyers can plan better and avoid surprises. This article will talk about the main problems first-time buyers face and give simple tips on how to overcome them. This can help first-time buyers to make smarter choices and find their dream homes more easily.

First-Time Buyers of Homes in Canada: Challenges and Solutions

First-time home buyers in Canada face several challenges, but there are also solutions available to help them navigate the process.

- High Property Prices

Right now, home prices in Canada are very high. Cities like British Columbia and Toronto have very expensive homes.

We can have a look below:

| Province | Average Home Price | Monthly Price Range | Annual Price Range |

| British Columbia | $1,001,736 | -0.4% | -1.5% |

| Ontario | $890,634 | -1.1% | -3.7% |

| Alberta | $507,706 | 1.6% | 8.0% |

| Quebec | $502,994 | 1.0% | 4.4% |

| Nova Scotia | $464,661 | -0.8% | 1.9% |

| Prince Edward Island | $391,819 | 3.3% | 3.1% |

| Manitoba | $371,224 | -3.0% | 3.6% |

| New Brunswick | $338,740 | 1.2% | 8.4% |

| Saskatchewan | $328,029 | 1.1% | 4.0% |

| Newfoundland and Labrador | $306,184 | 0.5% | 12.6% |

Because the cost is so much, many first-time buyers find it hard to afford a home. They need a lot of money for a down payment and monthly payments are also high.

Strategies to Overcome

- Exploring Different Neighborhoods: One way to deal with high prices is to look for homes in different neighbourhoods. Sometimes, houses in smaller towns or areas further from the city are cheaper.

- Considering Smaller or Older Homes: Another strategy is to consider buying a smaller or older home. These usually cost less money. Even if they need a little fixing up, it can still be cheaper than a new, big house.

- Strict Mortgage Requirements

To get a mortgage (a loan for buying a home) in Canada, you need to meet certain rules. The bank checks if you have a good income, a good credit score (a number that shows how well you manage money), and enough savings for a down payment (a part of the home price you pay upfront).

Many first-time buyers have problems with these rules. They might not have sufficient funds saved for a down payment. They might also have a low credit score, which makes it harder to get a loan.

Solutions

- Improving Credit Score Before Applying: One solution is to work on improving your credit score before applying for a mortgage. You can do this by paying bills on time, paying off debts, and not using too much of your credit limit.

- Saving for a Larger Down Payment: Another solution is to save more money for a down payment. The bigger your down payment, the less you need to borrow. This makes it easier to get a mortgage and can also lower your monthly payments.

- Limited Inventory

The housing market in Canada is currently very low, with only 3.9 months of homes available for sale across the country as of March 2023. This is called limited inventory. It happens when many people want to buy houses, but there are not enough units available.

As of May 2024, around 175,000 properties were listed on Canadian MLS® Systems, marking a 28.4% increase from last year but still below historical levels of 5 months of inventory.

This makes it harder for first-time buyers to find a house they like. They might have fewer choices and have to compete with other buyers, which can raise prices.

Tips to Overcome

- Being Flexible with Property Features: One tip is to be flexible about what you want in a home. Maybe you want a big yard or an extra bedroom, but if you can compromise, you might find a good home faster.

- Widening Search Radius: Another tip is to look for homes in a larger area. Instead of only looking at one region, check out nearby areas too. Sometimes, properties just a little further away are easier to find and less expensive.

- Engaging a Real Estate Agent for Better Options: Working with a real estate agent can help. Agents know about homes for sale that you might not find on your own. They can give you more options and help you find a home that fits your needs and budget.

- Hidden Costs and Fees

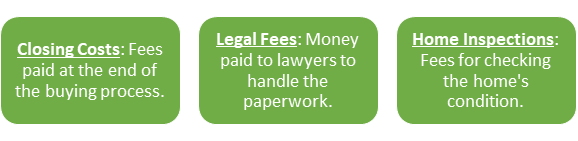

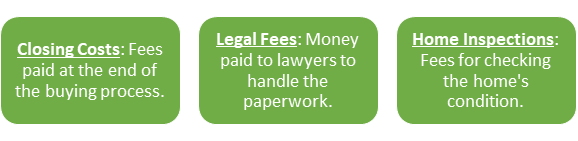

When you buy a home, there may be some extra costs you need to pay besides the home price. These include:

These extra costs can make it harder for first-time buyers. They need more money than they expected, which can be stressful and may delay buying a home.

How to Manage?

- Budgeting for Extra Expenses: Make a list of all possible expenses and set aside money for them. This way, you won’t be surprised when you need to pay them.

- Seeking Professional Advice: Talk to experts like financial advisors or real estate agents. They can help you understand all the costs and give advice on how to manage them.

- Negotiating with Sellers: Sometimes, you can ask the person selling the home to reduce the cost. This is called negotiating. It doesn’t always work, but it’s worth trying.

- Navigating the Home Buying Process

Buying a home is complicated. There are many steps to follow, like getting a loan, finding a home, making an offer, and closing the deal. So, it can be a little bit difficult to understand everything.

And, first-time buyers of homes often feel stressed and confused. They might worry about making mistakes or not knowing what to do next. This can make the process very overwhelming.

Guidance

- Consulting with a Real Estate Lawyer: It is a good idea to talk to a real estate lawyer. They know all the legal details and can explain things clearly. They make sure you understand the contracts and protect your rights.

- Using Checklists and Planning Tools: Using checklists and planning tools for buying homes can help you stay organized. Write down each step you need to take and check them off as you complete them. This way, you won’t forget anything and can see your progress.

- Market Competition

In popular places like Ontario, many people want to buy homes. This means there is a lot of competition. Everyone is trying to get the same houses, which makes it hard to buy.

When many people want the same house, they enter a bidding war. This is when buyers keep offering more money to win the house. Bidding wars make houses more expensive and can be stressful for buyers.

Strategies to Cope

- Getting Pre-Approved for a Mortgage: Before you start looking for a home, get pre-approved for a mortgage. This means the bank agrees to lend you a certain amount of money.

- Acting Quickly on Desirable Properties: When you find a home you like, act fast. If you wait too long, someone else might buy it.

- Considering Less Competitive Markets: If popular areas are too competitive, look in less popular areas. Homes in these places might be cheaper and easier to buy.

- Economic Uncertainty

The housing market is greatly affected by the economy. When the economy is good, more people buy homes. When the economy is bad, fewer people buy homes.

Things like job availability and interest rates can also change the housing market. People worry about losing their jobs or not making enough money. They also worry about interest rates, which are the cost of borrowing money. If interest rates go up, it becomes more expensive to get a mortgage.

Preparing for Uncertainty

- Building a Financial Cushion: Save extra money to help you in tough times. It can cover your expenses if you lose your job or face unexpected costs. When you have savings, it gives you peace of mind.

- Keeping Informed About Market Trends: Stay updated on what’s happening in the housing market and the economy. Read news articles or talk to experts like real estate agents. Knowing what’s going on helps you make better decisions.

Conclusion

Buying your first home in Canada can be tough because of high prices, strict rules for mortgages, and other challenges.

But don’t give up! If you plan ahead and stay patient while searching for homes, you can find the best one for you.