Medical Expense Insurance Vs. Medical Coverage for Auto Insurance: What’s the Difference?

Medical expense insurance and medical coverage for auto insurance may seem alike, but they’re not. Both keep you safe but in different ways.

Medical expense coverage helps with medical bills, no matter how you get hurt. While auto insurance medical coverage steps in only if you’re hurt in a vehicle accident. Understanding these differences is important to make sure you’re fully covered.

So, stick around, and we’ll explain more about how they are different from each other! We will also highlight some other important aspects like their coverage details, benefits, and more!

What’s Medical Expense Insurance?

Medical expense insurance is specifically designed to help you in paying your medical bills when you get sick or hurt.

Suppose you get jaundice and need to go to the doctor or hospital. In such cases, medical expense coverage will kick in and help pay for those bills. It doesn’t matter if you got hurt at home, playing sports, or anywhere else. This insurance is there to help cover the costs of your medical care.

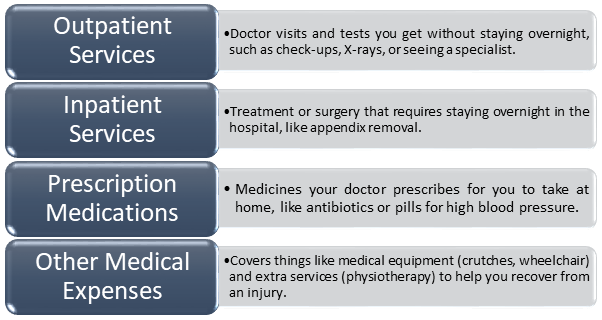

What’s covered in medical expense insurance?

What’s Medical Coverage for Auto Insurance?

Medical coverage on auto insurance is a type of protection that helps pay for your medical bills if you get hurt in a vehicle accident. So, if you’re injured while driving or riding in a car, your medical coverage car insurance can help cover the costs of your medical treatment, like visits to the doctor or hospital stays.

Suppose you’re driving to market with your friends, and suddenly, another car hits yours. Everyone’s okay, but you have a few cuts and bruises. That’s when this insurance comes to the rescue! Without it, you might have to pay for all medical bills yourself, which could be really expensive.

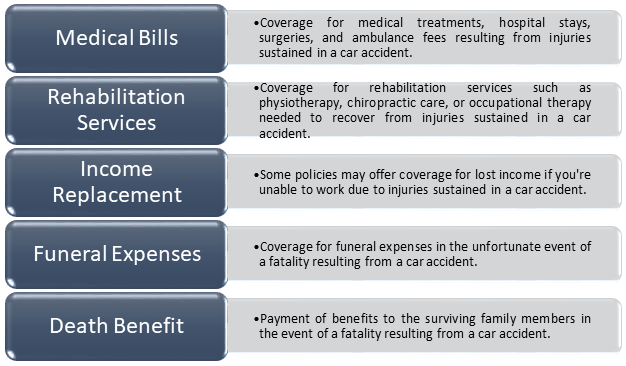

What’s usually covered in medical coverage on auto insurance?

Medical Expense Insurance Vs. Medical Coverage for Auto Insurance

Let’s break down the key differences between Medical Expense Insurance and Medical Coverage on Auto Insurance into simple terms:

- Coverage Scope: Medical expense coverage covers medical expenses for a wide range of situations, including illnesses, accidents at home, or injuries from sports. While the medical coverage for auto insurance covers medical expenses only if you’re injured in a car accident.

- Primary Aim: The medical expense cover helps with medical costs for illnesses or injuries, regardless of how they occurred. However, the auto insurance medical coverage specifically covers medical expenses resulting from auto accidents.

- Who Pays Money: In medical expense insurance, generally, the insured person is responsible for paying the deductible (the amount you pay before the insurance kicks in) and any co-payments or co-insurance.

In the medical coverage on auto insurance, typically, the insurance company of the at-fault driver covers the medical expenses for injuries sustained by the occupants of the insured vehicle.

- Availability: The first one can be purchased independently or through an employer-sponsored health plan. However, the second one is typically included as part of an auto insurance policy and is required by law in most jurisdictions in Canada.

- Factors Affecting Premium: For the first one, premiums are usually based on factors like age, health status, and coverage level chosen by the insured. For the second one, premiums are influenced by factors such as driving record, age, gender, and type of vehicle.

- Coverage Limits: In medical expense insurance, coverage limits vary depending on the policy and insurer but may have annual or lifetime maximums. However, the coverage limits of medical coverage on auto insurance may vary depending on the jurisdiction and specific policy.

- Flexibility in Use: The first one can be used to cover a wide range of medical services, including doctor visits, hospital stays, prescription medications, and preventive care. While the medical coverage car insurance primarily covers emergency medical care and treatment related to injuries sustained in car accidents.

Medical Expense Insurance Vs. Auto Insurance Medical Coverage: What to Choose?

Deciding between medical expense insurance and medical coverage on auto insurance is super important. Here’s how to do it:

- Think about your own needs

Check how healthy you are and how often you drive. If you’re mostly healthy and don’t drive much, medical expense insurance could be enough. But if you’re on the road a lot or worried about accidents while driving your car, then medical coverage car insurance might be better.

- Look at what insurance you already have

See what’s already covered in your other insurance plans, like the one from your job or your car insurance. Figure out if there are any gaps in coverage that you need to fill.

- Talk to insurance experts

Ask insurance agents or brokers for help. They can explain the differences between the two types of insurance and help you pick the right one for you. They can also tell you how much it’ll cost and what’s included.

- Pick the right coverage for your situation

Think about what you’re most worried about. If you’re concerned about any accidents, medical expense insurance might be good. But if you’re mainly worried about getting hurt in a car crash, then medical coverage car insurance could be better.

The Conclusion Points

To wrap up, it’s super important to understand the differences between medical expense insurance and medical coverage in auto insurance. Remembering the main points helps us see how important it is to have the right kind of protection. By knowing these differences, we can feel safe and calm, knowing we’re covered if something unexpected happens.

People Also Ask

Q. Can I use medical expense cover for routine check-ups?

Yes, medical expense cover can be used for routine check-ups with your doctor, as well as preventive care like vaccinations or screenings.

Q. Is medical expense coverage costly in Canada?

The cost of medical expense insurance in Canada varies depending on factors like your age, health, and coverage level. Some plans may have higher premiums but offer more comprehensive coverage.

Q. Does medical coverage in auto insurance cover passengers in my car?

Yes, medical coverage in auto insurance usually covers medical expenses for you and your passengers if you’re injured in a car accident, regardless of who was at fault.

Q. Do I need medical coverage in auto insurance if I have health insurance in Canada?

Medical coverage in auto insurance can provide additional protection specifically for injuries sustained in car accidents, even if you have health insurance. It can help cover expenses like deductibles or copayments.

Q. Will medical coverage car insurance pay for my lost wages if I can’t work after an accident?

Some policies may include coverage for lost wages due to injuries sustained in a car accident, but it depends on the specific terms of the policy.