Are Credit Cards from Desjardins Worth It? Don’t Miss This Comparison!

The decisions we make about credit cards hold a significance far beyond spending money. They also shape the very fabric of our financial future! And in today’s reality, the question of ‘whether credit cards from Desjardins are worth it?’ takes us to a whole new dimension.

Its logo speaks louder than its words. The hexagon shape represents the unity of its 6 components. While, the single and deep green shade evokes a sense of growth, development, and wisdom.

So, as we explore why Desjardins credit cards are worthy, we’ll also find out whether or not these cards stay true to the institution’s logo!

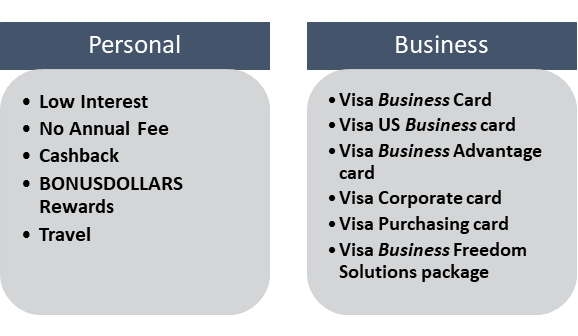

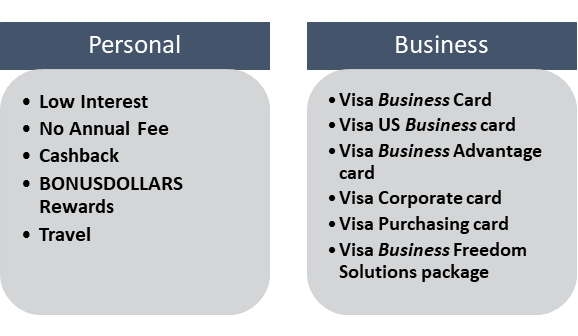

What Types of Credit Cards Desjardins Offer?

Primarily, there are 2 types of credit cards from Desjardins as shown below!

What Sets Credit Cards from Desjardins Apart in Terms of Features?

Here’s a list of the features that make credit cards from Desjardins different from others:

- BONUSDOLLARS Rewards Program

It’s a standout feature!

Just use your Desjardins credit card for purchases and watch your BONUSDOLLARS balance grow. Each BONUSDOLLAR you earn can be redeemed for amazing rewards, like meals, vacations, or even investments.

Additionally, with every ‘certain’ purchase you make with one of the Desjardins’ four BONUSDOLLARS credit cards, you add to your balance.

And the best part? One BONUSDOLLAR equals one dollar you can redeem, so it’s simple to keep track. For instance, if you’ve 300 BONUSDOLLARS, it means you can redeem $300.

- Flexibility In Redemption

You also have lots of choices when it comes to using your rewards. Once you’ve collected 20 or more BONUSDOLLARS, you can start redeeming them for various stuff.

First, you can treat yourself or someone special with gift cards. Just log in to AccèsD, pick the card with the BONUSDOLLARS you want to use, and go to the redemption section.

Then, check out the big selection of gift cards on bonusdollars.ca. Once you’ve picked your gift card, just enter your information and select ‘Checkout’. Digital gift cards usually arrive in 2 to 3 days, while physical ones take about 2 to 4 weeks to arrive.

But that’s not all!

You can also use your rewards for financial stuff. You can use them to pay for insurance, save money, or even repay a loan.

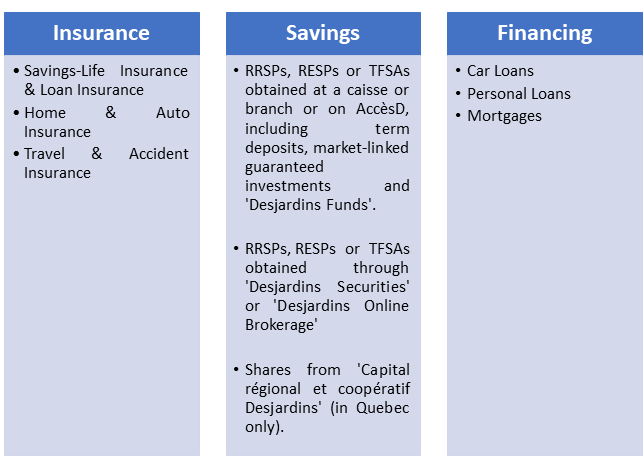

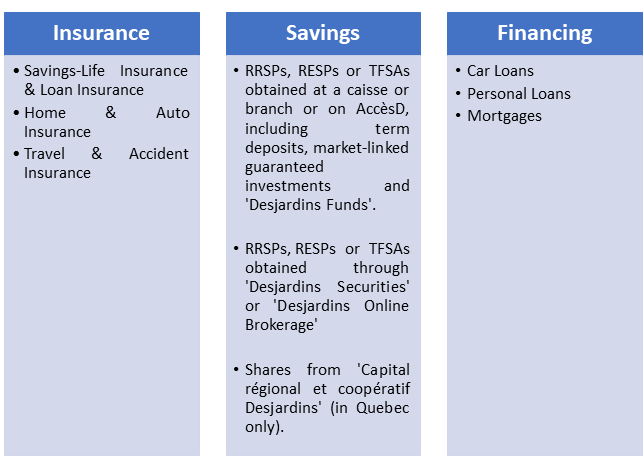

Here are the eligible products and services that come under credit cards from Desjardins:

For source, click here!

- Allows You To Pay Off Certain Purchases

You can use your BONUSDOLLARS rewards to pay for certain purchases made with your credit card.

Here’s how it works!

If you buy something that qualifies for this program, you have 60 days to use your BONUSDOLLARS to pay for it. This is even if you’ve already paid off your credit card bill. It’s a handy way to use your rewards and manage your expenses.

Here are the eligible redemption categories:

For source, click here!

- Online Account Management

With Desjardins, managing your credit card is easy with AccèsD, the online banking platform. Just sign up for AccèsD to access a range of tools and services designed to make banking simpler and save you time.

With AccèsD, you can do lots of things like lock or replace a card, transfer money between accounts, pay bills, check your statement, and even keep track of your BONUSDOLLARS or cash back balance—all from your computer or phone. It’s all about giving you control over your money whenever and wherever you need it.

The mobile app adds extra convenience, letting you check your account anytime, anywhere. You can get alerts for important activities, use handy financial tools, and even call the helpline number for help—all right from your phone.

But that’s not all—AccèsD also lets you access TransUnion’s CreditView Dashboard, where you can keep an eye on your credit report and credit score. It’s a secure way to stay informed about your credit health without affecting your score.

- Robust Security

If you’ve misplaced your card or think it might have been stolen, Desjardins has got you covered with some handy options to keep your account safe and stop any shady transactions. Instead of rushing to call, just hop onto AccèsD and hit the ‘Lock Card’ button to temporarily put a freeze on your card and keep it safe from any sneaky moves.

This card lock feature gives you some much-needed peace of mind while you try to find it or wait for a replacement.

And that’s not all—Desjardins also looks out for you with top-notch fraud protection. If there’s any unusual activity on your credit card account, they’ll immediately send you a text message alert so you can act fast and reduce any potential risks. Plus, they’ve got your back with ‘Zero Liability Protection’, meaning you’re not on the hook for any fraudulent transaction made with your card.

But wait, there’s more—Desjardins takes it up with their ‘Identity Protection’ services. If the worst happens and your identity gets swiped, they’ve got your back with comprehensive support to keep your money safe and help you through the rough patch.

Detailed Comparison of Personal and Business Credit Cards from Desjardins

While comparing personal and business credit cards from Desjardins, several key factors come into play. Let’s have a look at them below!

| Personal Credit Cards | |||

| Name | Interest Rate On Purchases | Interest Rate On Cash Advances | Annual Fees |

| Flexi Visa | 10.9% | 12.9% | None |

| Cashback Visa | 20.9% | 21.9% | None |

| Cashback Mastercard | 20.9% | 21.9% | None |

| Bonus Visa | 20.9% | 21.9% | None |

| Cash Back World Elite Mastercard | 20.9% | 21.9% | $100 |

| Odyssey Gold Visa | 20.9% | 21.9% | $110 |

| Odyssey World Elite Mastercard | 20.9% | 21.9% | $130 |

| Odyssey Visa Infinite Privilege | 11.9% | 12.9% | For Desjardins Members: $295 For Non-Members: $395 |

| Business Credit Cards | ||

| Name | Interest | Annual Fees |

| Visa Business Card | Prime Rate + 8.5% | 1 To 4 Cards: $60/Card 5 Or More Cards: $40/Card |

| Visa US Business Card | 19.4% | US$30/Card |

| Visa Business Advantage Card | NA | NA |

| Visa Corporate Card | Prime Rate + 5% | $20/Card |

| Visa Purchasing Card | Prime Rate + 5% | $20/Card |

| Visa Business Freedom Solutions Package | Prime Rate + 3.5% To 8.0% | Monthly Fees: $17 For The Package |

The Conclusion Points

So, are credit cards from Desjardins worth it?

With their comprehensive benefits, user-friendly features, and commitment to security, the answer seems clear. Desjardins credit cards offer not just financial tools, but a pathway to a brighter financial future.

They offer distinct features and benefits, such as BONUSDOLLARS Rewards, low-interest rates, and flexible redemption options, to name a few. They stand out as compelling options for consumers and help them to progress in their lives.

This matches their logo’s principles, proving Desjardins credit cards stay true to the organization’s values!