Smart Saving Strategies for GTA Millennials: Achieving Financial Independence

Introduction

The millennial generation in the Greater Toronto Area (GTA) faces unique financial challenges, including high living costs and student loan debts. However, millennials may attain financial independence and create a secure future with the appropriate saving techniques. In this article, we will explore smart saving strategies tailored to the specific needs of GTA millennials, empowering them to take control of their finances and work towards their long-term goals.

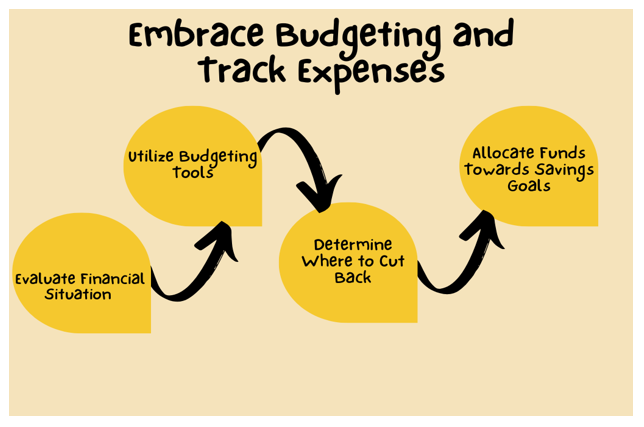

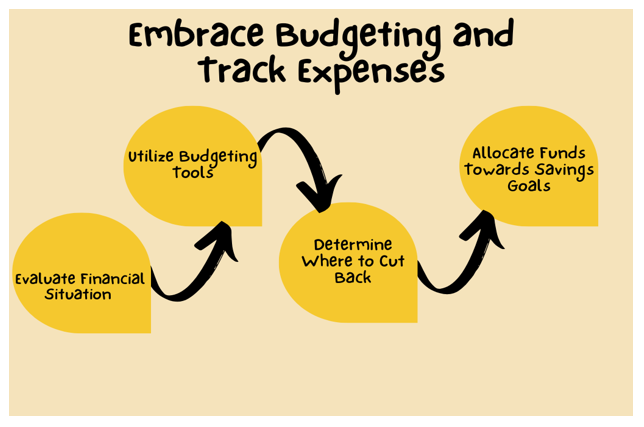

Embrace Budgeting and Track Expenses

Evaluate your Financial Situation:

- Assess your income, fixed expenses, and discretionary spending.

- Understand your financial obligations and sources of income.

Utilize Budgeting Tools:

- To keep track of your spending, think about utilizing spreadsheets or budgeting tools.

- You may see your spending habits and spot opportunities for change with the aid of these tools.

Determine Where to Cut Back:

- Examine your discretionary expenditures on things like entertainment and food.

- Look for opportunities to reduce expenses in these areas and redirect those funds towards savings goals.

Allocate Funds Towards Savings Goals:

- Prioritize your financial objectives, such as building an emergency fund or saving for a down payment.

- Set aside some money, particularly for these objectives, and then change your budget to reflect this. Regularly Evaluate and Modify: Schedule a monthly review of your budget and progress tracking.

- Make the required modifications to make sure your budget matches your financial objectives.

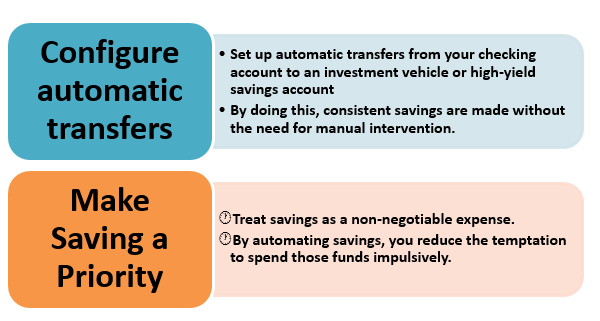

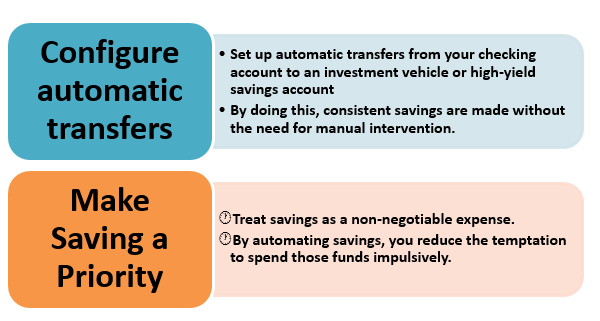

Save automatically:

Reduce Housing Costs:

Consider Alternative Living Arrangements:

- Explore co-living spaces or find roommates to split housing costs.

- This can significantly reduce your monthly expenses. Downsize or Relocate:

- Evaluate your current living situation and consider downsizing to a smaller apartment.

- Explore neighborhoods with lower rent or more affordable housing options. Explore Homeownership Options:

- Compare mortgage rates and explore first-time homebuyer programs or government assistance.

- These initiatives can aid in lowering the cost of homeownership.

Take a Strategic Approach to Student Loans:

Review the loan terms:

- Recognize the conditions of your student loans, such as the interest rates and available repayment alternatives.

- You may create a thoughtful repayment strategy with the use of this knowledge.

- Examine Consolidation or Refinancing:

- Look into ways to possibly reduce interest rates and make payments easier, such as loan consolidation or refinancing.

- Put high-interest loans first:

- In order to reduce long-term interest payments, concentrate on paying off high-interest loans first.

- Make consistent, on-time payments to build your credit score.

Seek Grants, Scholarships, or Part-Time Jobs:

- Look for opportunities to supplement your income and offset student loan payments.

- Look into financial aid opportunities including grants, scholarships, or part-time employment.

- Boost Income through Side Hustles: Identify Marketable Skills:

- To find suitable side jobs that play to your strengths, evaluate your talents and hobbies.

- It could include freelance work, tutoring, or starting an online business. Leverage Digital Platforms:

- Explore online platforms or gig economy apps to find side hustle opportunities.

- These platforms increase your earning potential by connecting you with new customers.

Strategically Allocate Additional Income:

- Spend the additional money from side jobs on investments, debt payments, or savings.

- Set specific financial goals for this additional income to maximize its impact.

- Adopt a Minimalist Lifestyle:

- Focus on Essential Spending:

- Prioritize spending on essential needs rather than unnecessary materialistic purchases.

- Evaluate whether each purchase adds value to your life before making it.

Accept Experiences Over Possessions:

- Put more emphasis on experiences, connections, and personal development.

- Allocate resources towards activities that enrich your life. Sell or Donate Unneeded Items:

- Organize your living space by getting rid of whatever you don’t use or need and selling or donating it.

- Use the proceeds from these sales to boost your savings or pay off debts. Practice Intentional Spending:

- Consider if an investment fits your beliefs and long-term objectives before you make it.

- Avoid impulse buying and make conscious decisions about where to allocate your financial resources.

Emphasize Quality over Quantity:

- Instead of accumulating a large number of possessions, focus on acquiring high-quality items that will last longer.

- This approach reduces waste and promotes a more sustainable and cost-effective lifestyle. Cultivate Gratitude and Contentment:

- Appreciate what you already have and find joy.

- The urge for excessive material items decreases with the development of a grateful and satisfied mentality.

Conclusion:

Embracing smart saving strategies is crucial for GTA millennials to achieve financial independence. By embracing budgeting and tracking expenses, automating savings, reducing housing costs, strategically managing student loans, boosting income through side hustles, and adopting a minimalist lifestyle, millennials can take control of their finances and work towards their long-term goals. Each strategy plays a vital role in creating a solid financial foundation and cultivating healthy financial habits. Consider that becoming financially independent needs discipline, persistence, and dedication to making wise financial decisions. Put these ideas into practice right away to create a safe and wealthy future.