Does the Stress Test Impact Your Mortgage Affordability?

Indeed, it is tough! Housing prices are on the rise & the criterion to get a mortgage loan is getting stricter. On top of it, there is a mandatory “stress test” that every new homebuyer has to undergo.

There is a relationship between the stress test and mortgage affordability, which is often an important criterion that decides whether you will get a mortgage loan. Understand the connection through this interactive blog.

What is a Stress Test?

The world faced an economic crisis in 2008. Indeed, the impact on Canada was milder when compared with America and Europe, but there was a subsequent drop in the productivity rate and employment opportunities.

Before this crisis, Canadians bought houses without paying any down payment. The maximum amortization period was even 40 years. And there was nothing called a “stress test”.

Intrigued by several instances of foreclosures, the Government of Canada made several changes in 2008 to combat the economic crisis. In 2016, finally, it included the introduction of a mandatory “stress test” which made availing of mortgage loans stricter.

It is a method that checks your financial prowess and whether you will be able to afford the high mortgage payments.

How does it work?

A stress test increases your mortgage rate for evaluation purposes and checks whether you will meet the increased monthly mortgage payments. The qualification rate is calculated in the following manner:

Higher* of:

- The 5-year benchmark rate as notified by the Central Bank of Canada (5.25% as of June 2021)

- The mortgage rate at which you have obtained a mortgage loan from your lender plus 2%.

*The qualification rates are reviewed annually by The Office of the Superintendent of Financial Institutions (OFSI) and The Minister of Finance.

Let us broaden our understanding through a practical example.

You are looking for a condominium in the Greater Toronto Area (GTA) and have shortlisted a few properties. You are desirous of obtaining a pre-mortgage approval before seriously forwarding the offer letter.

You went to a leading mortgage lender based on your profile; you got an offer having the following details:

| Mortgage Loan | $500,000 |

| Mortgage Term | 20 years |

| Mortgage Rate | 3.75% |

| Monthly Mortgage Payments | $2,964 |

The bank executive told you to undergo a stress test. Your qualification rate was 5.75% (higher of: 5.25% and 5.75% (5.25%+2%).

You were required to prove you could afford to pay the monthly mortgage fee calculated at 5.75% amounted to $3,510.

What is Mortgage Affordability?

You might be willing to buy a lavish villa with a swimming pool. But it entirely depends on whether you will be able to afford it. The mortgage lenders usually refer to two distinct ratios for this purpose. These are:

| Mortgage Affordability Ratios | Formula | Description |

| Gross Debt Service Ratio (GDS) | Total Housing CostsGross Family Income x 100Total Housing CostsGross Family Income x 100 | Total housing costs are the aggregate of: Your monthly mortgage payments Property taxes Heating expenses Condo fees GDS only considers your mortgage debt. |

| Total Debt Service Ratio (TDS) | Total Housing Costs+Cost of Other Debt PaymentsGross Family Income x 100Total Housing Costs+Cost of Other Debt PaymentsGross Family Income x 100 | The “cost of other debt payments” considers the interest cost of all your other debts, such as: Credit card balance Student loan Personal loans, etc. |

Furthermore, CMHC (Canada Mortgage and Housing Corporation) has suggested an ideal percentage for both GDS and TDS that is often referred to by most mortgage lenders. These are:

| Mortgage Affordability Ratio | Ideal Percentage |

| GDS (Gross Debt Service) Ratio | Must be less than 39% |

| TDS (Total Debt Service) Ratio | Must be less than 44% |

Gain a better understanding of mortgage affordability through this example.

You have a gross monthly income (before taxes) of $8,500. You pay a combined monthly fee of $150 towards condo and heating expenses. Besides, all your debt obligations are as under:

| Type of Debt | Monthly Payment |

| Mortgage | $2,500 |

| Credit Card Balance | $550 |

| Personal Loan | $1,150 |

| Student Loan | $300 |

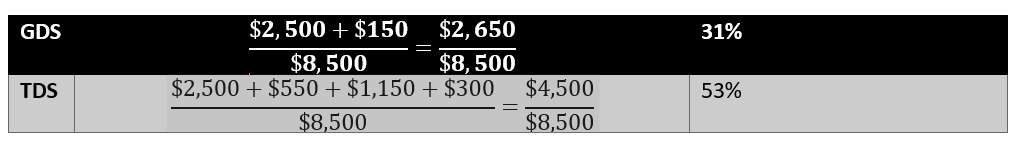

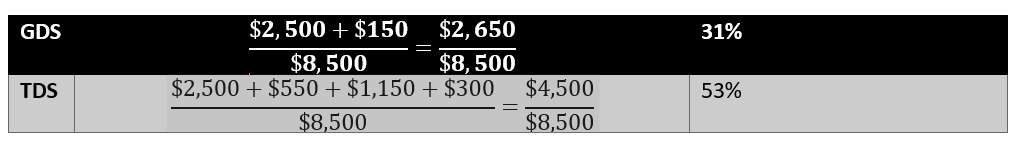

In such a case, your GDS and TDS ratios will be:

Does Stress Test Reduces Mortgage Affordability?

Indeed, YES. When your monthly mortgage payments are increased based on the qualification rate, your GDS and TDS get severely affected. Consequently, this reduces your mortgage affordability and chances of securing a mortgage loan.

Are you still confused? Well, let us learn through another example.

Let us assume that your gross family income is $7,500 per month. If you want to be within the ideal GDS percentage as suggested by the CMHC – the maximum monthly mortgage fee is $3,315 ($7,500 x 39%)

Using reverse calculation (for 20 years and mortgage rate at 3.5% p.a.), the maximum purchase price you can afford is $571,591.

Now, if the rate is to be increased by another 2%, the maximum purchase price you can afford is $481,910 for the same tenure of 20 years.

Due to an increase in the mortgage rate under the stress test, affordability has been reduced from $571,591 to $481,910. It is a drop of 15.68%, approximately 16%.