TD Bank Minimum Account vs. National Bank – The Minimalist Chequing Account

The TD Bank Minimum Chequing Account serves all your basic banking needs. It allows you to earn rewards. Click here to get started.

We have a National bank–The Minimalist Chequing Account that lets you perform banking transactions at minimum fees. You can get your account instantly by clicking here.

Let us compare these chequing accounts and see the perfect option for you.

1. TD Bank Minimum Chequing Account

The TD Bank Minimum Chequing Account manages your day-to-day banking with ease. It offers you all banking services and even lets you earn rewards.

WELCOME OFFER

This bank account is not offering you any opening cash bonus or introductory benefits.

FEATURES

- Eligibility

a. Be a Canadian resident or a permanent resident.

b. Be a major as per the age of majority set by your province.

c. Must have your valid ID Proof

d. You must have your valid email address not shared with anyone else

Interest Rate:

- This chequing account does not offer any interest on balances maintained.

Minimum Balance:

- There is no requirement for any minimum balance.

Transactions:

- You can do 12 free debit transactions every month. This limit includes two full-serve transactions

- Every additional debit transaction will cost you $1.25 per transaction

- For Interac e-Transfer, pay the following fee:

- Up to $100 – $0.50 per transaction

- More than $100 – $1.00 per transaction

Monthly Fees:

- There is a monthly fee of $3.95

- However, you will get a waiver if:

- You are a senior citizen (aged 60 or more) and are collecting a Guaranteed Income Supplement

- You are a registered beneficiary of the Disability Savings Plan

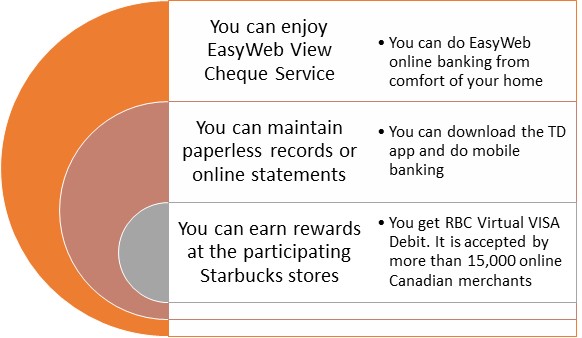

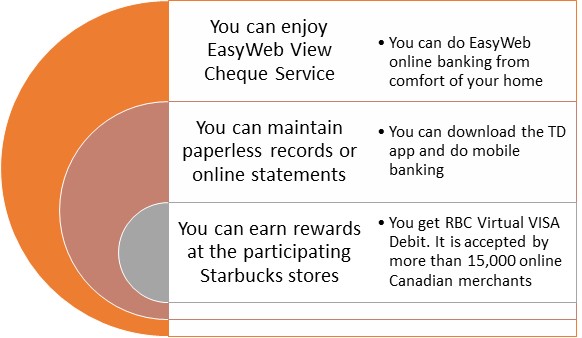

- Additional Benefits

2. National bank – The Minimalist Chequing Account

National bank–The Minimalist Chequing Account let you do maximum banking at affordable rates. You can deposit mobile cheques and even transfer funds online.

WELCOME OFFER

This chequing account is not offering you any introductory offer or an opening cash bonus.

FEATURES

- Eligibility

| a. | You are a Canadian resident. |

| b. | Must be at least 18 years old. |

| c. | Must have a valid Canadian Photo ID. |

| d. | You must have a mobile device for taking a selfie and a photo of your ID. |

Interest Rate:

- You do not get any interest in this chequing account.

Minimum Balance:

- There is no requirement for any minimum balance.

Transactions:

- Unlimited and Free Interac e-Transfer

- You can do 12 debit transactions per month. This limit includes two full-serve transactions you can do at the counter.

Monthly Fees:

- There is a monthly fee of $3.95

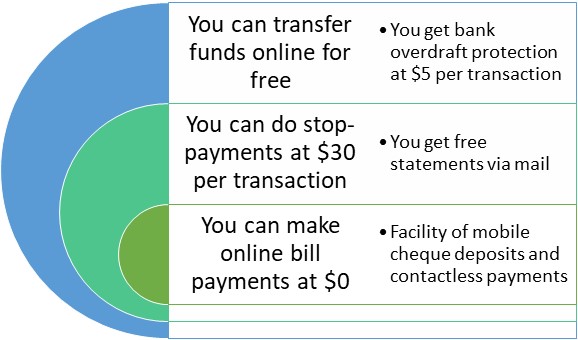

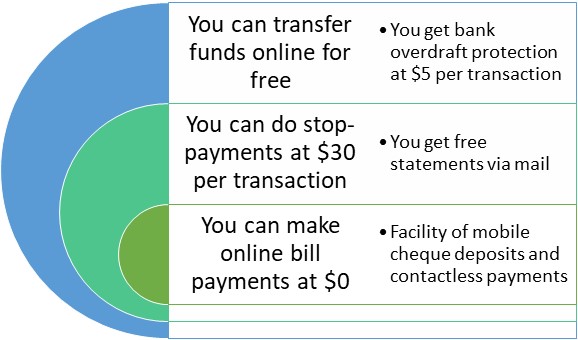

Additional Benefits

COMPARATIVE ANALYSIS

We compare the typical features of the accounts through a table.

| Parameters | TD Bank Minimum Chequing Account | National bank – The Minimalist Chequing Account |

| Opening Cash Bonus | Not applicable | Not applicable |

| Monthly Fees | $3.95 | $3.95 |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Free Debit Transactions | 12 per month | 12 per month |

Out of the five parameters mentioned above, there is a tie in all of them.

OPINION of Expertbyarea. money

Both the chequing accounts mentioned in this article are identical and target customers with basic banking needs. National bank–The Minimalist Chequing Account scores higher by offering Unlimited and free Interac e-Transfer.

Evaluate your requirements. Choose the best account that better serves your needs