Bank of Montreal Air Miles Account vs. National bank – The connected chequing account

The Bank of Montreal Air Miles Account not only offers you banking services but also lets you earn rewards. You can click here to open this account online.

National Bank’s–The Connected Chequing Account offers you several benefits at a nominal monthly fee.

Let us compare both chequing accounts.

1. Bank of Montreal Air Miles Account

The Bank of Montreal Air Miles Account is one of the best chequing accounts for earning rewards. It can help you save money by letting you earn REWARD MILES.

WELCOME OFFER

This account does not offer any opening cash bonus or other introductory offers.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Have a Canadian address. |

| c. | Be a major as per the age of majority set by your province. |

| d. | You must have your Social Insurance Number (SIN) |

Interest Rate:

- You do not get any interest in this chequing account

- However, you can open a free Premium Rate Savings Account along with it and earn 0.10% p.a. interest on balances

Minimum Balance:

- There is no requirement for any minimum balance.

Transactions:

- Unlimited debit transactions every month

- Unlimited Interac e-Transfer

- You can even do Global Money Transfers at $0 until October 31, 2022

Monthly Fees:

- There is a monthly fee of $16.95

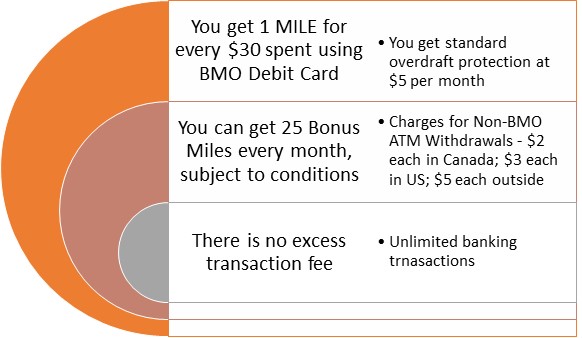

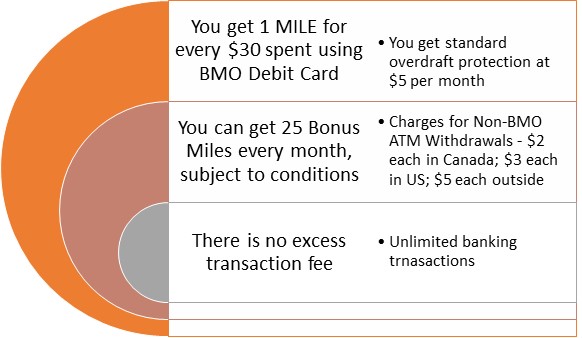

Additional Benefits

2. National Bank’s – The Connected Chequing Account

With this chequing account, you get unlimited access to all your digital transactions. You get to enjoy several benefits as well. Read out all the terms and conditions by clicking on this link.

WELCOME OFFER

If you open a chequing account until October 31, 2022, you are eligible for a cashback of $300.

FEATURES

- Eligibility

| a. | You must be a Canadian resident. |

| b. | Be a major as per the age of majority set by your province. |

- Interest Rate:

- This account does not offer any interest rate

- Minimum Balance:

- There is no requirement for any minimum balance

- Transactions:

- The Interac e-Transfer is unlimited and free

- Monthly Fees:

- The monthly fee associated with this chequing account is $15.95

- However, you can waive your monthly amount if you maintain a minimum balance of $4,500.

Additional Benefits:

- If you get enrolled in any eligible credit card, you get $30 off

- You can transfer funds online and make international payments using Mastercard and Interac

- You can make all contactless payments through this chequing account

- You can make a mobile cheque deposit

COMPARATIVE ANALYSIS

Let us now compare both these chequing accounts:

| Parameters | Bank of Montreal Air Miles Account | National Bank’s – The Connected Chequing Account |

| Opening Cash Bonus | $0 | $300 cashback |

| Monthly Fees | $16.95 | $15.95 |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Debit Transactions & Interac e-Transfers | Unlimited | Unlimited |

Out of the five parameters mentioned above, the National Bank’s – Connected Chequing Account scores higher among the two. There is a tie in all the other three parameters.

OPINION of Expertbyarea.Money

Both the chequing accounts cover all your banking needs and offer unlimited debit transactions and Interac e-transfers.

However, what majorly separates them is the potential to earn AIR MILES points. The Bank of Montreal Air Miles Account lets you earn 1 AIR MILE on every $30 spent via your BMO Debit Card.

The National Bank’s – The Connected Chequing Account offers you a lucrative $300 opening cash bonus. The bank will charge a $15.95 monthly fee. You can avoid this if you maintain a minimum balance of $4,500.

Evaluate your requirements. Choose the best account that better serves your needs.