TD (Toronto Dominion) Bank Minimum Chequing Account for Seniors vs. Meridian Personal Senior Chequing Account – best Seniors’ Chequing

The TD Bank Minimum Chequing Account for Seniors is for those with minimal banking needs. You can do online banking and even enjoy EasyWeb view bank cheque services.

The second on our agenda today is the Meridian Personal Senior Chequing Account. It includes several exciting features and better serves the banking needs of seniors. Click here to open this account.

Let us compare these chequing accounts and see the perfect option for you. You can also connect with any of our verified financial experts and get FREE advice.

1. TD Bank Minimum Chequing Account for Seniors

WELCOME OFFER

As of now, this bank account is not offering you any opening cash bonus or introductory benefits.

FEATURES

- Eligibility

| a. | You are a Canadian. |

| b. | You are 60 years or above. |

| c. | You must have a valid ID. |

| d. | You must have your valid email. |

Interest Rate:

- This chequing account does not offer any interest on balances maintained.

Minimum Balance:

- There is no requirement for any minimum balance

Transactions:

- You can do 12 free debit transactions every month. This limit includes two full-serve transactions

- Every additional debit transaction will cost you $1.25 per transaction

- For Interac e-Transfer, pay the following fee:

- Up to $100 – $0.50 per transaction

- More than $100 – $1.00 per transaction

Monthly Fees:

- There is a monthly fee of $3.95

- However, you will get a waiver if:

- You are a senior citizen (aged 60 or more) and are collecting a Guaranteed Income Supplement

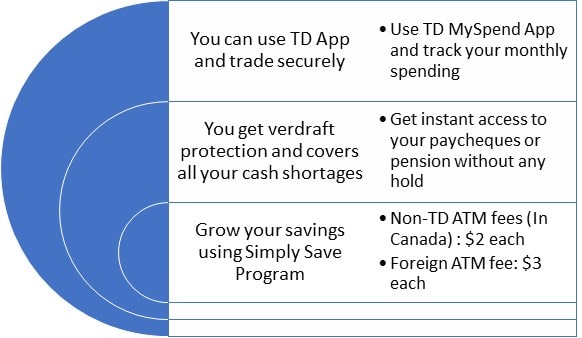

Additional Benefits

2. Meridian Personal Senior Chequing Account – By Meridian Credit Union

WELCOME OFFER

The chequing account is not offering you any introductory offer or an opening cash bonus.

FEATURES

- Eligibility

| a. | You are a Canadian. |

| b. | You are 60 years or above. |

| c. | You have a valid government-issued ID, like a Driving License, Passport, etc. |

- Interest Rate:

- You do not get any interest in this chequing account

- Minimum Balance:

- There is no requirement for any minimum balance.

- Transactions:

- Unlimited and Free Debit Transactions

- Four free Interac e-Transfer every month

- Monthly Fees:

- There is no monthly fee

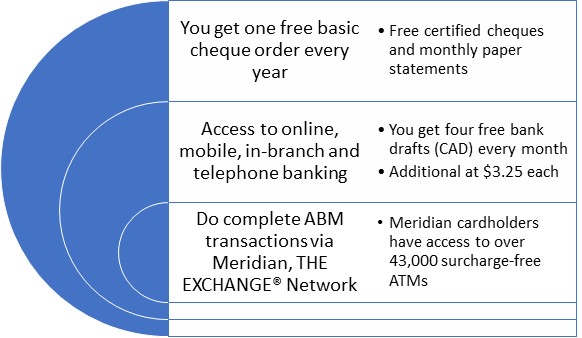

Additional Benefits

COMPARATIVE ANALYSIS

We compare the features of the accounts through a table.

| Parameters | TD Bank Minimum Chequing Account for Seniors | Meridian Personal Senior Chequing Account – By Meridian Credit Union |

| Monthly Fees | $3.95 | $0 |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Free Debit Transactions | 12 per month | Unlimited |

| Free Interac e-Transfers | None | 4 per month |

Out of the five parameters mentioned above, Meridian Personal Senior Chequing Account – By Meridian Credit Union scores higher among the three. There is a tie between the other two.

OPINION of ExpertByArea.Money

Unlimited banking, Zero monthly fees (unconditional), Free bank drafts (four every month), and access to 43,000 surcharge-free ATMs – Indeed, Meridian Personal Senior Chequing Account can make your second childhood stress-free and enjoyable.

It even offers free certified cheques, bank cheques, and monthly paper statements.

TD Bank Minimum Chequing Account for Seniors charges limit your banking. If you are not receiving a pension from Guaranteed Income Scheme, they will also charge you $3.95 as monthly fees. Also, say no to free Interac- e-Transfers as all are chargeable.

Evaluate your requirements. Choose the best account that better serves your needs. www.ExpertByArea.Money has hundreds of premium experts who can understand your requirements and offer FREE advice.