Is Terrorism Insurance Worth Investing In For Your Next Trip?

It just happens. If you are a newsreader, you must know how suddenly and quickly all these terrorist activities unfold. Are you going on a trip to the affected region? You will, of course, unpack your travel bags and cancel your vacations. In such cases, terrorism insurance can help you cover the trip cancellation expenses. Let us explore further and read out more about this policy.

Source: Freepik

What is a Terrorism Insurance?

A recent study reveals only between 2018 and 2020, 44 different instances of terror attacks (extreme-right wing plots) across the European Union and the United Kingdom. The gravity of the situation is such that you never know when there will be a bomb blast and who will be the targets.

Indeed, a terrorism insurance policy will not come in handy when they have captivated you, say, Jaish-e-Mohammad or ISIS. But it can certainly help when you have cancelled your trip due to such terror activities.

A terrorism insurance policy allows you to:

- Cancel your upcoming trip or vacation because some terrorist activities or civil unrest unfolded.

- Get reimbursed by the insurance company for the expenses incurred in cancelling the trip.

Further,

- A terrorism insurance policy covers your trip cancellation expenses.

- This policy will reimburse you if there have been instances of terrorism due to which it is not safe for you to travel to that city/ country.

- The terrorist acts must occur within 30 days of arrival in such an affected country.

- We note that this insurance policy does not cover strikes, riots, political disturbances, and cases of general civil unrest.

- Also, this policy excludes all the places the Government of Canada has issued a “travel warning.”

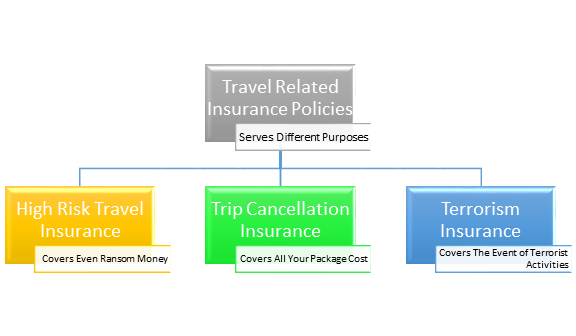

Different Travel Related Policies and Their Uses

“Insurance industry is a mess. There are just so many products, clauses, and terms that I cannot comprehend them completely and select the best policy for me,” said Noah Smith, a resident of the Greater Toronto Area who recently had a trip cancellation insurance policy.

Well, Noah is not alone. Such is the diversity and quantum of insurance products in the market that most people are at the mercy of insurance providers for buying an appropriate insurance plan.

However, www.Expertbyarea.money aims to provide you with unbiased information based on which you can decide on your best course. Here is a list of the three most common travel-related policies:

| S. No. | Travel Related Insurance Policy | What is Covered? | Example |

| 1. | High-risk Travel Insurance | • It covers all kinds of risky destinations, such as war zones, hostile environments, remote locations, etc. • You get reimbursed for some of the most exceptional situations, such as kidnapping, ransom money, etc. | • You are an adventure traveler and prefer to travel to risky locations and war zones • You recently traveled to Venezuela, which has been remarked as “Avoid all travel” by the Government of Canada • You were unlawfully detained in the country by the locals and after paying $50,000 in cash you were released • You had high-risk travel insurance and after proving your claim, you were able to get reimbursement from the insurance company |

| 2. | Trip Cancellation Insurance | • It covers situations wherein you were forced to cancel your trip because of: a) Your death or any major injury b) Death/ Injury to any of your travel companions or family member • Your destination place was closed due to natural disasters, rough weather, political instability, etc. • You were summoned by a court due to which your movements were restricted | • Williams and Sean decided to go on a trip to Sri Lanka (an island country in South-west Asia) • They purchased a tour package worth $25,000 • They purchased a trip cancellation insurance policy as well upon the advice of one of their friends • Due to situations of riots and political as well as economic instability, they decided to cancel their trip just three days before their departure • They got a reimbursement of their entire claim and were saved from financial losses |

| 3. | Terrorism Insurance | • If you are forced to cancel your trip due to terrorist activities, then you can claim your losses under this policy | • You and your wife wanted to go out on a 7-day London Tour • You purchased a “couple tour package” from the travel agency on 29th September 2022 • Your scheduled date of departure is 15th December 2022 • You even purchased a terrorism insurance policy because of London’s past terror-related history • On 2nd December 2022 you heard the news about several bomb blasts on CTV News • You immediately cancelled your upcoming trip to London • Since the terrorist attacks unfolded within 30 days, you got reimbursement from the insurance company |

Should I Buy a Terrorism Insurance Policy?

The answer lies with you. Most travellers prefer to stay away from countries and cities that have a notorious terrorism-related past. The Government of Canada even issued these places a negative travel advisory. You can check out all such locations through this link.

Hence, if you are a vigilant, conservative, and not an insanely adventurous traveller, then buying a terrorism insurance policy might not help you out.

However, on the other side, if you are an adventurer, or a journalist or a researcher, buying this policy can certainly protect you from financial losses about trip cancellation.