What Are the Best Ways for Tapping into Home Equity for Seniors in 2024?

Are you a senior with valuable financial assets but limited access to cash? Many retirees face this challenge. Fortunately, home equity offers a solution.

Through options like reverse mortgages, you can unlock the equity tied to your property without selling your home or moving out. This option offers financial flexibility while allowing homeowners to remain in their cherished homes.

In this article, we’ll delve into how reverse mortgages work and why they might be an appealing option for availing home equity for seniors.

What is Home Equity for Seniors?

Home equity comprises all the portion that you truly own i.e., which doesn’t come under any debt. This works like the equity tied up in your property. Home equity is determined by calculating the difference between the present property’s rate and the debt on the mortgage.

For instance:

If you have a home whose current financial value is $250,000 and you owe a mortgage of $70,000 on it. Thus, your home equity is calculated up to $180,000 i.e., $250,000 – $70,000.

Gradually, as you own your new home, its financial value increases, and the loan levied on that decreases which increases its equity. Therefore, it is a valuable financial resource that increases with time. For seniors (55 or older) this home equity is quite a useful financial source as it provides a way to access money without having to sell your home or move out.

According to the 2016 Census, nearly 45% of Ontario homeowners were already at or near retirement, with 88% having less than $200,000 in savings. This means that many retirees are “asset-rich but cash-poor,” with their wealth associated with their real estate. However, with the help of reverse mortgages their associated wealth can be converted into a steamy cash flow.

Why Consider a Reverse Mortgage for Home Equity?

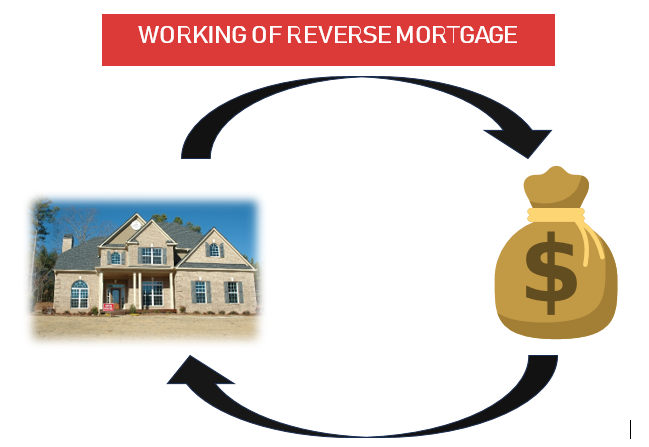

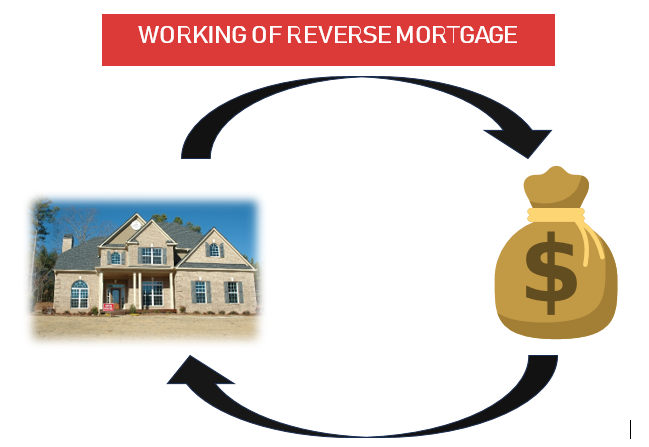

A reverse mortgage for home equity is a loan that is designed specifically for homeowners who are above 55. It enables seniors to borrow money against their home equity without selling the property or making monthly payments. However, the loan is repaid only when one of the things happens i.e., if the homeowner sells the house, passes away, or moves out of the house.

The money can be given by the lender as a monthly sum, total sum, or a line of credit. This reverse mortgage is beneficial when the cash dries up or you are in immediate need of money. However, it can also act as an alternate source of income that is used for paying bills, covering healthcare costs, making home improvements, or just having extra cash for retirement.

Nearly around three in every five Canadian senior homeowners report that access to small amounts of cash—between $1,000 to $3,000 per month—would significantly help them meet everyday necessities like groceries and bills. Therefore, having access to this mortgage as home equity for seniors will help them to manage their financial issues.

How Does Reverse Mortgage Work in Canada?

Reverse mortgages allow many Canadians to open doors to financial stability via their home equity. These not only help them to receive money without selling the property but also help them turn that money into tax-free cash.

Here’s a brief overview of how this works:

| ELIGIBILITY |

| Eligibility criteria for qualifying this mortgage is: You must be at least 55 years old.The home must be your primary residence.Both you and your spouse must meet the age requirement if you’re co-owners. |

| HOW MUCH MONEY CAN YOU BORROW? |

| The money you can take via reverse mortgage depends on the following factors: Age of borrower and spouse if co-owners.Home’s location and its condition.The number of secured debts against your home (if any).Type of your home. However, homeowners have access to approximately 55% of the current price of their property. For instance: If you’ve paid off your house’s original $300,000 mortgage and it’s now worth $500,000, you could potentially get a reverse mortgage for up to 55% of $500,000, which is $275,000. |

| RECEIVING THE FUNDS |

| It is solely your choice on how to receive the funds- as a gross sum, monthly subscription, or a line of credit. However, these funds are purely tax-free, therefore these won’t affect your Old Age Security (OAS) or Guaranteed Income Supplement (GIS) benefits. Additionally, it doesn’t need any regular payments to be made to repay the loan. Instead, this gets accumulated with interest over time. |

| REPAYMENT OF LOAN |

| The loan is repaid when the borrower: 1. Sells the home, 2. Move out of the home, 3. Passes away. However, it is important to remember that it follows non-recourse characteristics. This secures the borrower as they will never owe greater than the value of the property. Even if the home’s market value falls below the loan balance, heirs won’t be responsible for the difference. |

What Benefits Do Seniors Avail from Reverse Mortgages in Canada?

There are various pros to dealing with reverse mortgages in Canada:

- Additional Source of Income at Retirement

With rising costs and expenses, around 46% of senior Canadians consider part-time work to manage their financial expenses. Almost a quarter (23%) couldn’t handle unexpected expenses over $15,000, like home repairs or medical bills. Therefore, having the support of a reverse mortgage can provide extra funds for daily or unexpected expenses.

- Extra Aid to Pay Off Debts

The funds from a home equity loan or reverse mortgage can provide seniors with extra money to pay off existing debts, including their current mortgage, credit cards, or medical bills. This financial assistance helps reduce monthly payments and alleviate stress, offering greater financial stability and peace of mind.

- Ownership Remains Still

Traditionally, one needs to sell their property to receive a huge amount of money. However, with this one can receive a lump sum of money even without selling and the property’s 100% rights remain as it is.

- Flexibility

This program offers huge flexibility, whether it is receiving money or tax-free income. Borrowers can choose their receiving option as a lump sum, line of credit, or monthly, and they don’t even get taxed. Additionally, it doesn’t affect other government programs.

Conclusion

A reverse mortgage is a valuable financial tool for using home equity for seniors. One of the most significant impacts that it causes is seniors can stay in their homes and at the same time can access additional funds.

However, it’s crucial to understand the terms and explore all options before making a decision. It is highly recommended that one should consult with a Mortgage Agent before taking any step forward.

FAQs

Q1. Can the borrower’s heirs inherit the home?

Yes! Definitely. Heirs can inherit the home. However, they will need to repay the reverse mortgage balance (loan amount plus interest) to retain the ownership. In the case when the home is sold, the rest equity that is left after repaying the loan is allied to the heirs.

Q2. What if the home’s value decreases and is less than the loan amount?

Reverse mortgages in Canada include a “non-recourse” clause. This means heirs cannot owe more than the property’s value when it’s sold. Even if the loan amount exceeds the property’s market value, heirs are not responsible for paying excess payments.

Q3. Can a borrower still qualify for a reverse mortgage if he has an existing mortgage?

Yes, but any outstanding mortgage balance must be paid off first. This is done typically using funds from the reverse mortgage. This ensures the reverse mortgage becomes the primary debt on your home.