How to Find the Best Mortgage Rates in this Competitive Environment?

In today’s fast-paced housing market, finding the best mortgage rate can feel like hunting for a needle in a haystack. The property prices are high, competition is tough, and everyone needs an affordable place to live. But don’t worry—it’s easier than you think!

Just like shopping for the best deal on a phone or car, you can also shop around for the best mortgage rates. This post will show you simple tips to compare rates, understand what affects them, and help you save money on your dream property in Canada.

Let’s get started on making this big decision a little easier!

What are Mortgage Rates?

Mortgage rates are the interest rates you pay on the money borrowed to buy a home. They decide how much extra you’ll pay on top of your loan every month.

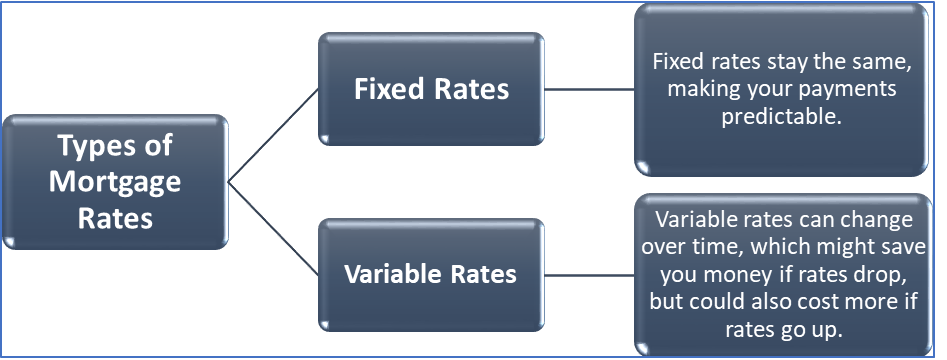

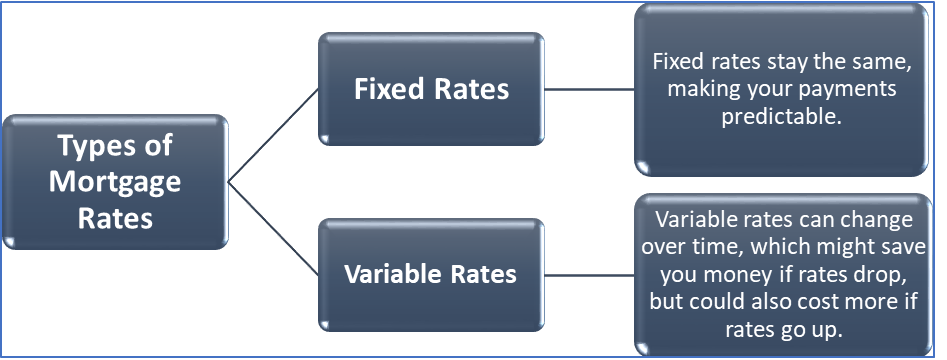

There are two types of mortgage rates as follows:

Fixed rates offer stability, while variable rates can be risky but might be cheaper. Choose based on what feels right for your budget and comfort.

How to Find the Best Mortgage Rates?

You want to save money, get the best terms, and feel secure about your choice.

But how do you do that? Let’s break it down!

- Gathering Quotes and Comparing Them

Start by gathering quotes from different lenders. A quote tells you what a lender is willing to offer. It includes the interest rate, loan amount, term and amortization. Don’t settle for the first offer you get. Instead, get at least three to five quotes from different lenders.

Once you have these quotes, compare them. Look at the interest rates first, but don’t stop there. Check the loan terms, fees, and any special conditions. A lower rate might look good, but hidden fees can make it more expensive in the long run. Make sure to compare the total cost over the life of the loan, not just the monthly payment.

- Understanding the Terms

Mortgage terms can be confusing, but they are important when searching for the best mortgage rates. The terms include the length of the loan, the interest rate type, and the conditions for paying off the loan early or making lumpsum payments.

A 25-year term means you’ll pay off the loan in 25 years at the existing rate, while a 30-year term means it will take 30 years to pay off at the same rate. A fixed-rate mortgage has the same interest rate for the chosen term, while a variable-rate mortgage can change in the chosen term. Make sure you understand what each term means and how it will affect your payments.

- Negotiating Your Mortgage Rate

Did anyone tell you that mortgage rates can be negotiated? Many people don’t realize this. Lenders want your attention, and they might be willing to lower the rate or reduce fees if you ask.

Start by showing them quotes from other lenders. This can make them more likely to offer you a better deal. You can also ask for discounts if you have a good credit score or if you’re making a large down payment.

Don’t be afraid to negotiate. Even a small reduction in the interest rate can save you thousands over the life of the loan.

- Building a Strong Financial Profile

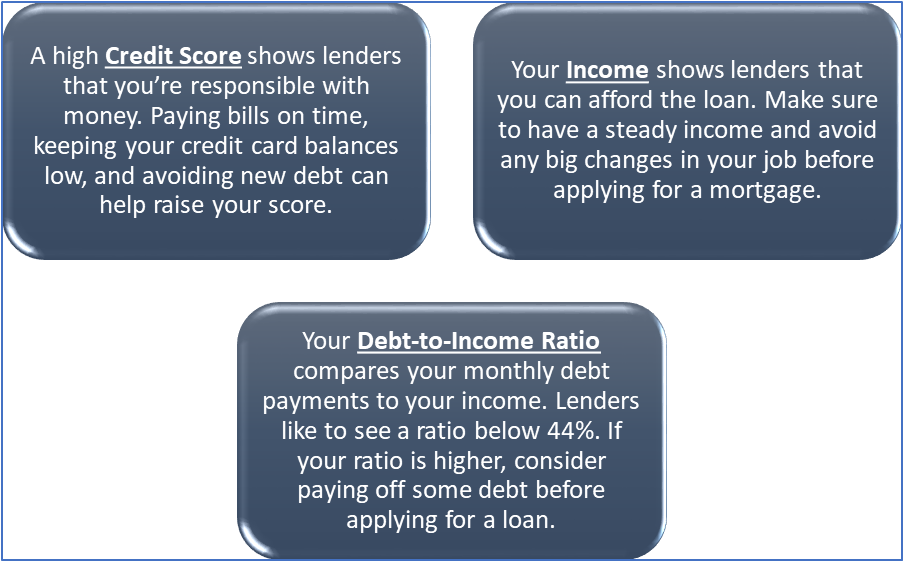

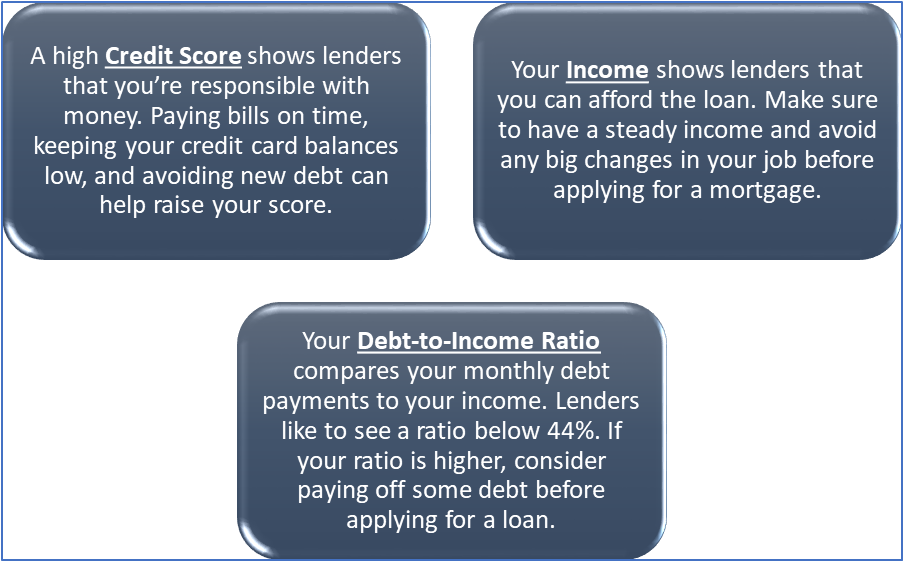

Your financial profile is how lenders decide whether to give you a loan and what rate to offer. A strong financial profile means you’re more likely to get the best mortgage rates.

To build a strong profile, focus on three things:

- Your Credit Score

- Your Income

- Your Debt-to-Income Ratio

- Consider Longer Amortization Carefully

Longer mortgage terms, like 30 years, mean lower monthly payments but more interest paid over time. Shorter terms, like 25 years, have higher payments but save money on interest.

Pros and Cons of Longer Terms

- The main benefit of a longer-term is lower monthly payments. This can make it easier to manage your budget, especially if your income is tight. You’ll also have more flexibility to save or invest elsewhere.

- However, the downside is that you’ll pay more interest over the life of the loan.

When to Choose Longer Terms?

- A longer term might be beneficial if you need lower payments to afford the home you want.

- It can also be a good option if you’re planning to sell the home before the loan is paid off.

- Timing Your Mortgage Application

Timing can have a big impact on the mortgage rate you get. Interest rates change over time and applying when rates are low can save you money.

Market Trends

Interest rates go up and down based on the economy, inflation, and other factors. Keeping an eye on these trends can help you choose the best time to apply for the best mortgage rates.

In Canada, rates can be affected by local housing demand, the Bank of Canada’s decisions, Bond yields, and even global events.

Common Mistakes to Avoid While Searching for the Best Mortgage Rates

Finding the best mortgage rates can save you a lot of money. However, there are some common mistakes that Canadians make. Let’s look at these mistakes so you can avoid them.

- Neglecting to Check Your Credit Score

Your credit score plays a big role in fetching you the best mortgage rate. If you don’t check it, you might miss out on better rates. Always check and improve your score before applying.

- Ignoring Pre-Approval

Skipping pre-approval can hurt your chances of getting a good rate. Pre-approval shows sellers and lenders you’re serious. It also helps you understand how much is your affordability.

- Not Comparing Multiple Lenders

Only talking to one lender can lead to higher costs. Always compare offers from several lenders. This way, you can find the best rate.

- Not Understanding Different Rate Types

Fixed and variable rates are different. If you do not understand them, it can lead to costly mistakes. So, it’s important to know the pros and cons of each type before choosing.

- Ignoring the Impact of Down Payment Size

A bigger down payment can lower your rate. Ignoring this could mean paying more over time. Consider saving up for a larger down payment.

- Not Considering Future Rate Changes

Variable rates can change over time. Not thinking about this can lead to higher payments later.

Conclusion

Finding the best mortgage rates in Canada can save you money and make buying a home easier.

By comparing quotes, understanding terms, and avoiding common mistakes, you can secure a great rate. Stay informed about market trends and choose wisely to get the best deal for your new home.