Why You Can’t Miss Credit Cards Tangerine Offer? Learn How to Boost Your Savings!

Are you tired of credit cards that offer minimal rewards? Do you find it hard to maximize your savings? You’re not alone!

Many face challenges in finding a credit card that aligns with their financial goals. According to Finder.com, 84% of Canadians choose their credit cards based on rewards, while 37% consider the annual fee and 8% look at interest rates. And even if they choose one, they struggle to save money despite their best efforts.

But there’s a solution: Tangerine Credit Cards!

In this post, we’ll explore why credit cards from Tangerine stand out as a beacon of promised rewards and savings in an overcrowded market.

What Options of Credit Cards Tangerine Offer?

There are two types of credit cards from Tangerine, as shown below!

What are the Common Features and Benefits of Credit Cards from Tangerine?

Both credit cards of Tangerine, the ‘World Mastercard’ and ‘Money-Back Credit Card’, can easily fit your spending habits. Check out some common features and benefits shared by them:

- No Annual Fees

Both cards do not charge any annual fee. This means you can enjoy using these cards without worrying about extra charges every year. It’s great for anyone looking for a simple and affordable way to manage their finances.

Additionally, the ‘no annual fee’ feature makes these cards accessible to a wide range of individuals. Whether you’re a smart shopper, a frequent traveler, or just want to handle your everyday expenses better, credit cards from Tangerine are a good choice.

- 2% Cashback on Categories of Your Choice

With Tangerine credit cards, you get to pick up to 3 spending categories where you’ll earn a higher 2% cashback rate. These categories include groceries, restaurants, gas, and more.

Additionally, you’ll earn 0.5% cash back on all other purchases, so you’re rewarded for every purchase you make.

- Automatic Deposition

Your cashback rewards are automatically deposited into your account every month. There is no need to wait for a specific time or meet a minimum threshold.

You’ll see your cashback rewards accumulating in your account month after month, allowing you to enjoy the benefits right away.

- Unlimited Money Back

Unlike other cards that limit how much cashback you earn; Tangerine credit cards give you the freedom to earn without any caps. Be it dining out, purchasing groceries, or shopping online, every purchase adds to your cashback rewards.

That’s the major reason why these cards are a top pick for individuals who want simple add-ups without any complicated reward structure.

- Save Smartly on Transfers

This feature of credit cards from Tangerine lets you handle debts while saving big on interest rates. For the first 30 days after getting your card, you can transfer your balance from other credit cards and enjoy a super-low interest rate of just 1.95% for the first 6 months.

But remember, after the first 6 months, the interest rate switches to a competitive 19.95%. Also, there’s a small ‘Balance Transfer Fee’ of 1% on the amount you transfer.

Despite this, the ‘Transfer and Save’ feature is a valuable tool for anyone looking to get a grip on their debt.

- Easy Online ‘Pause My Card’

Misplacing your credit card can be nerve-wracking. But with Tangerine Credit Cards’ ‘Pause My Card’ feature, there’s no need to fret.

With just a few clicks on the website or mobile app, you can temporarily suspend your card, giving you peace of mind while you search for it. This feature is a simple and effective way to prevent unauthorized use of your card if it’s stolen or lost.

- Purchase Assurance and Extended Warranty

Besides protecting your card, you may get coverage for eligible items in case they’re lost, stolen, or damaged. Additionally, you get an extended warranty on certain purchases.

With coverage of up to $60,000, you can relax knowing your purchases are safeguarded against unexpected events. This feature not only offers financial security but also boosts your confidence when making purchases.

- 100% Recycled Plastic

Taking care of the planet is a pressing issue in today’s scenario. And, Tangerine is doing its part by making its cards from 100% recycled plastic. This eco-friendly choice helps cut down on new plastic use and slashes the carbon dioxide (CO2) emission from making cards.

So, if you’re an eco-conscious being, go for Tangerine!

- Orange Alerts

In today’s busy world, staying on top of your money is a must. That’s why Tangerine credit cards offer the ‘Orange Alerts’ feature. They’re like little reminders that help you stay informed about what’s happening with your account.

You can set up notifications for stuff like big purchases, payment deadlines, or anything fishy going on with your account.

And the best part? You can pick how you get your alerts – by text or email.

- Efficient Digital Support

No matter what gadget you are using, Tangerine has got you covered. Just add your credit card to your mobile wallet and enjoy hassle-free contactless payments wherever you go.

And that’s not all!

Tangerine’s ‘Left to Spend’ feature is a game-changer for keeping track of your shopping. It shows you exactly where your money is going and how much you have left to spend each month. With this smart tool, you can make better financial decisions.

How Do Tangerine’s ‘World Mastercard’ and ‘Money-Back Credit Card’ Differ from Each Other?

After knowing the similarities in the above section, let’s explore the differences between these two credit cards from Tangerine:

| Parameters | World Mastercard | Money-Back Credit Card |

| Eligibility | You need to meet one of these conditions: Earn $50,000 or more annually Have a household income of $80,000 or more. Hold $250,000 or more in Tangerine Savings or Investment Accounts Besides, you must also: Be in the age of majority in your province. Be a Canadian permanent resident. Have no bankruptcies in the last 7 years. | You need to meet the following conditions: Have a gross annual income of $12,000 or more. Be in the age of majority in your province. Be a Canadian permanent resident. Have no bankruptcies in the last 7 years. |

| Range of Cashback Rewards | Rewards on everyday purchases + Mastercard travel benefits + mobile insurance + rental car, and more! | Rewards on everyday purchases |

| Additional Benefits | Get an extra 10% back on up to $1000 of your everyday purchases in the first 2 months. | NA |

| Rental Car Collison/Loss or Damage Insurance | Get rental car collision, loss, or damage insurance (including damage and theft protection for car rentals) | NA |

| Mobile Device Insurance | Get up to $1000 coverage for your mobile device | NA |

| Travel Rewards | Unlock cashback offers at select merchants while traveling outside of Canada | NA |

| Travel Pass by DragonPass | Access exclusive dining, retail, and spa deals at 650+ airports worldwide, plus entry to 1300+ airport lounges for $32 per visit. | NA |

| Boingo Wi-Fi | Stay connected with access to over 1 million Wi-Fi hotspots globally through Boingo Wi-Fi. | NA |

| On-Demand & Subscription Services | Enjoy special benefits from on-demand apps and subscription services, all available exclusively with ‘World Mastercard’. | NA |

What Tangerine Credit Card to Choose?

Choosing between the ‘Tangerine World Master Card’ and the ‘Tangerine Money-Back Credit Card’ boils down to what you need.

If you’re all looking for advantages like rental car insurance, airport lounge access, and mobile device coverage, World Mastercard is good to go. But if you prefer simplicity and cashback rewards without any fuss, the Money-Back Credit Card is the way to go.

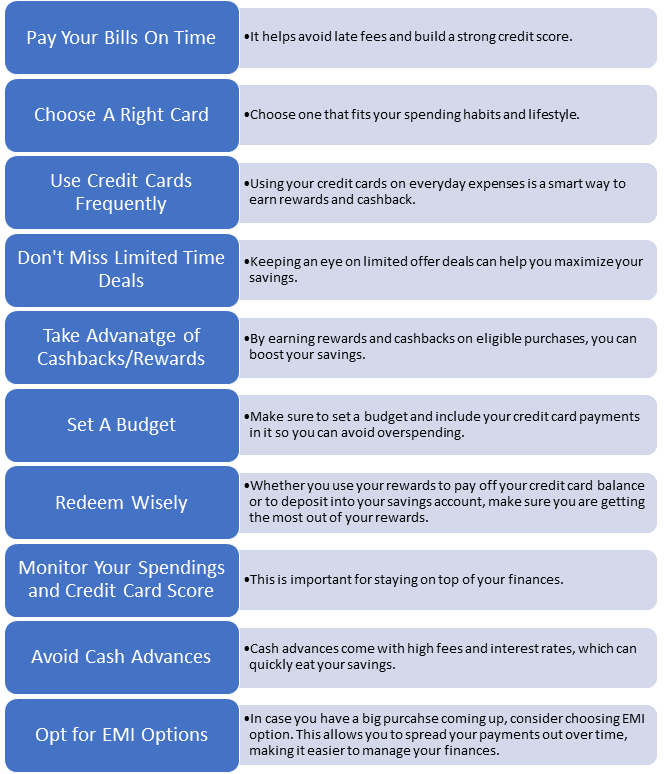

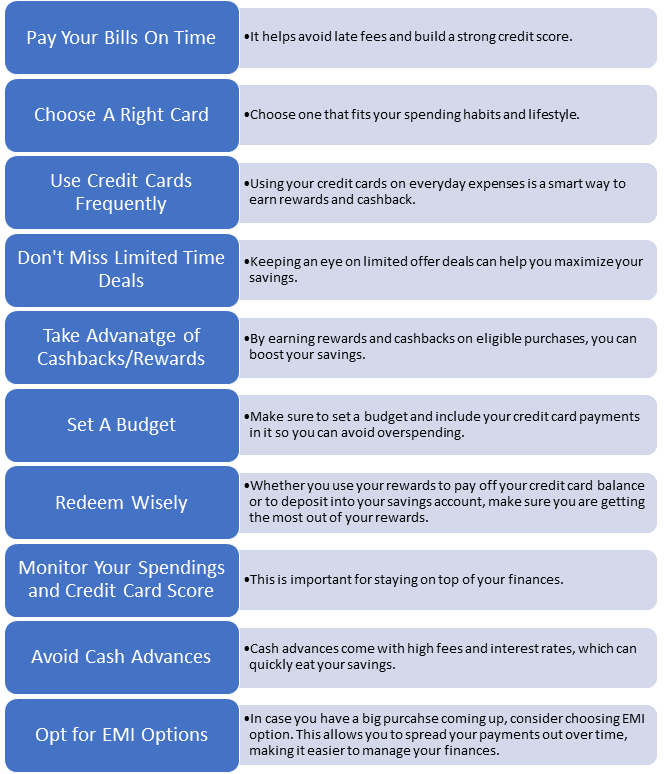

How to Boost Your Savings with Credit Cards Tangerine Offer?

Let’s take a closer look at how you can make the most of your Tangerine credit card to maximize your savings:

The Bottom Lines: Why Credit Cards from Tangerine Matters?

In conclusion, the Tangerine credit cards are a great way to boost your savings. Their unique features and rewards can help you reach your financial goals faster.

Don’t miss the chance to take control of your finances and start saving more with these cards today!