Choosing the Ideal Credit Card for Greater Toronto Area Residents

By taking into account your income, credit score, and planned use, choose the credit card that best suits your unique needs. Discover the process of applying for a credit card, conduct thorough research to identify the most suitable options that cater to your needs, ensure you improve your credit score without causing it to decline, and gain additional knowledge on related topics. Selecting the perfect credit card is a crucial financial decision for residents of the Greater Toronto Area (GTA). You can identify a credit card that aligns with your unique needs by considering income, credit score, and card usage habits.

This article serves as a comprehensive guide, providing insights on applying for a credit card, researching the best options, and even improving your credit score without causing further harm.

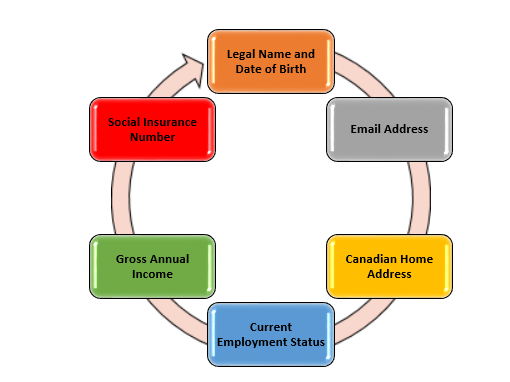

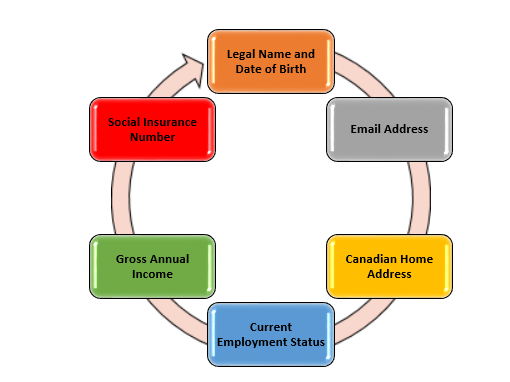

Essential Requirements for Applying for a Credit Card

Applying for a credit card in Canada necessitates precise information and paperwork to guarantee a smooth application procedure. When applying for a credit card in Canada, you must provide particular information such as your full legal name, date of birth, email address, Canadian home address, work details, gross yearly income, and, in some situations, a Social Insurance Number.

Full Legal Name and Date of Birth:

- When applying for a credit card, individuals must provide their full legal name and date of birth.

- This information helps establish their identity and ensure compliance with legal requirements.

Contact Email

- To facilitate contact during the application process, a working email account is essential.

- Important notices, statements, and other account-related information are sent through email by credit card issuers.

Canadian Home Address:

- Applicants must provide their Canadian home address as proof of residency.

- In some cases, additional information may be required, such as the duration of residency and previous addresses.

Current Employment Status:

- Credit card applications typically ask for the applicant’s current employment status.

- It includes providing details such as job title and, in some cases, contact information for the employer.

Gross Annual Income:

- Applicants must disclose their gross annual income, representing their total earnings before taxes and deductions.

- While proof of payment is optional, providing an accurate estimate is crucial.

- Misrepresenting income violates credit card terms and can lead to legal consequences.

Social Insurance Number (SIN):

- Although generally optional, applicants may be asked to provide their Social Insurance Number (SIN) during the application process.

- The SIN helps verify identity and may be used for credit checks.

Residency Status and Credit Cards for New Canadians in the Greater Toronto Area:

To apply for a credit card in Canada, individuals must typically be Canadian residents or citizens. However, newly landed immigrants have options available to them as well.

- In the Greater Toronto Area (GTA), several banks and financial institutions offer specialized financial services tailored to the needs of new Canadians.

- These services may include credit cards with specific eligibility criteria, such as alternative documentation requirements or credit-building programs designed to assist newcomers in establishing credit history.

- Residency status is crucial, but new Canadians in the Greater Toronto Area have access to tailored financial services to help them successfully navigate the credit card application process.

Ideal Credit Card

Selecting the ideal credit card is akin to finding a compatible partner, as it requires careful consideration and finding the perfect match for your financial needs. In the bustling credit card market of the Greater Toronto Area (GTA), where numerous options abound, it’s essential to navigate the selection process wisely.

- Identifying the ideal credit card involves a blend of subjective judgment and objective analysis.

- No one credit card outshines all others across every category or for every individual.

- Nonetheless, by gaining insight into the available choices and posing pertinent inquiries, you can discover the card that aligns most suitably with your spending patterns and credit circumstances.

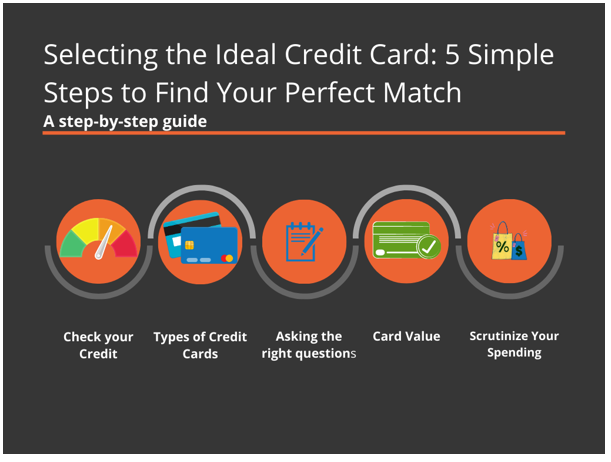

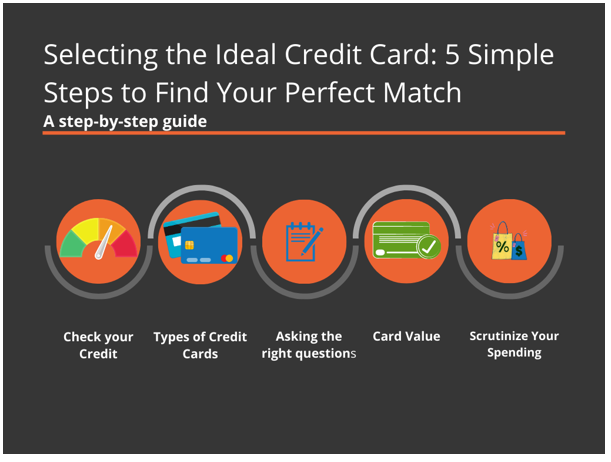

Five Simple Steps to Find Your Perfect Match:

1. Check your credit score

- Verifying your credit score is a simple process that may give useful assistance when choosing the best credit cards for your requirements.

- Numerous safe online businesses provide free credit score checks, or you may contact Equifax or TransUnion, the two major credit agencies, for a charge.

- Credit scores are assigned a numerical value between 300 and 900.

- A higher score indicates better creditworthiness and implies lower credit risk.

- Typically, to be eligible for most conventional credit cards, a minimum credit score of 650 is often required.

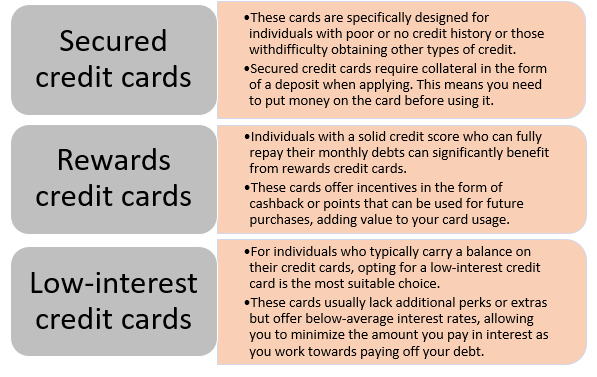

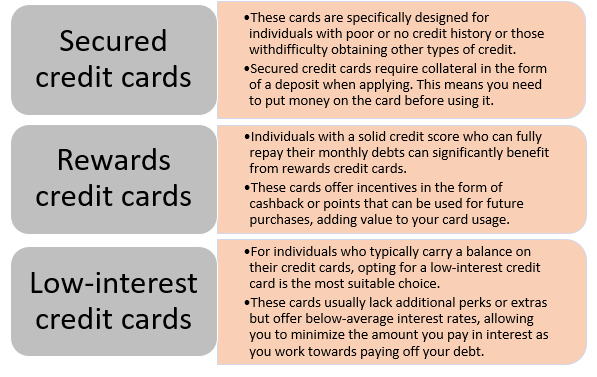

2. Types of Credit Cards:

Identifying the appropriate credit card type for your needs involves considering three main options, each with advantages and disadvantages.

Secured credit cards

3. Streamline Your Credit Card Options with Effective Questioning

Consider these key questions when reviewing top credit card options:

- For student and secured cards: Will it help build credit? What are the costs, including annual fees? Can you graduate with a better card later?

- For low-interest, 0% APR, or balance transfer cards: How long is the 0% APR period? What’s the ongoing interest rate? What’s the balance transfer policy? Does it offer rewards?

- For rewards, travel, or cash-back cards: Does it align with your spending habits? Is it straightforward or complex? How quickly will you earn rewards, and what’s their value?

4. Evaluating Credit Card Value:

When facing difficulty in selecting a credit card, it’s beneficial to step back and assess its overall value. Here are essential questions to help with the evaluation process:

What is the worth of the welcome bonus?

Consider if the sign-up incentive, such as bonus points or cash back, is valuable to you based on your preferences and needs.

Is the annual fee justifiable?

Assess the potential benefits of the card, such as point-earning potential and insurance coverage, to determine if they offset the yearlycost.

Are the perks worth the cost?

Evaluate the extra perks associated with premium cards, like lounge access or priority treatment, and consider their importance and frequency of use. Opt for a lower annual fee card if these perks are insignificant.

5. Examine Your Spending Habits for Credit Card Clarity:

- Understanding your spending habits is critical when choosing the best Torontonian credit card.

- Identify if you frequent specific retailers, focus on travel-related expenses, or allocate significant funds to groceries and gas.

- By recognizing where your money goes, you can discover cards tailored to reward those specific spending categories, leading to potential savings or earnings.

Conclusion

In conclusion, finding the perfect credit card in the Greater Toronto Area (GTA) requires careful consideration and research. Applicants must provide essential information, including their full legal name, date of birth, Canadian home address, employment details, and gross annual income. While the Social Insurance Number (SIN) is optional, it may be requested for identity verification and credit checks. New Canadians in the GTA can explore tailored financial services to help with the credit card application process. To identify the ideal credit card, individuals should check their credit score, consider different card types, ask pertinent questions about each option, evaluate their value based on rewards and fees, and align the card with their specific spending habits.