Avoiding Scams and Fraud: Expert Guidance from GTA’s Banking Professionals

Scams and fraud are more common and sophisticated than ever in the modern digital age. People must be aware of the risks and take the appropriate safety precautions as online banking and e-commerce have become more popular. The Greater Toronto Area (GTA) is the center of the financial industry, and its experts have a wealth of knowledge to impart. In this post, GTA banking professionals will offer their professional advice on how to avoid fraud and scams in order to assist you protect your financial security.

Understanding Common Scams:

Phishing Scams:

Phishing schemes involve deceptive attempts to collect personal data by pretending to be a reliable organization, such as passwords, credit card numbers, or Social Insurance Numbers (SINs).

- To avoid falling for phishing scams, be skeptical of unsolicited emails or texts requesting personal information.

- Check emails for spelling and grammar errors because they could be indicators of phishing attempts.

- Avoid downloading attachments from shady sources or clicking on dubious websites.

- Check the URL and look for secure HTTPS connections to confirm the legitimacy of websites.

Identity Fraud:

A person who obtains your personal information and exploits it in fraud is said to have committed identity theft.

Use the following advice to safeguard yourself against identity theft:

- Keep your personal information private by avoiding giving it to websites that aren’t secure or via unencrypted connections.

- Be wary of unauthorized demands for personal information made by phone, email, or in person.

- Before getting rid of documents with private information, shred them.

- Keep a regular eye out for any unlawful activity on your bank and credit reports.

Online Shopping Scams:

- Fraudulent websites, knockoff goods, and merchants who never deliver purchased goods are all components of online shopping scams.

- Shop at reputable internet stores, and confirm their reliability by reading reviews and ratings.

- Use trusted third-party payment platforms or secure payment methods like credit cards.

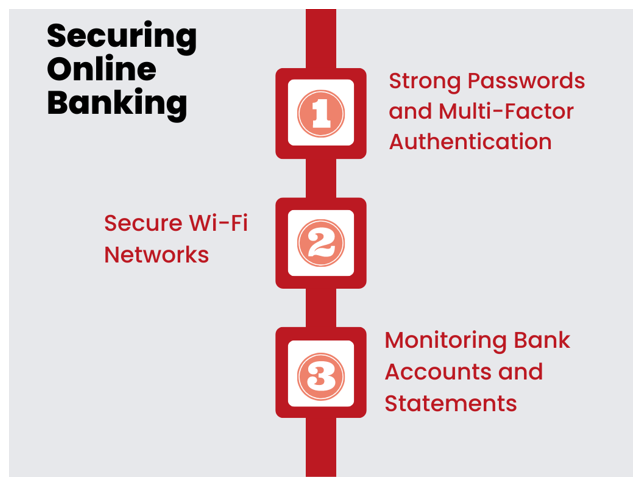

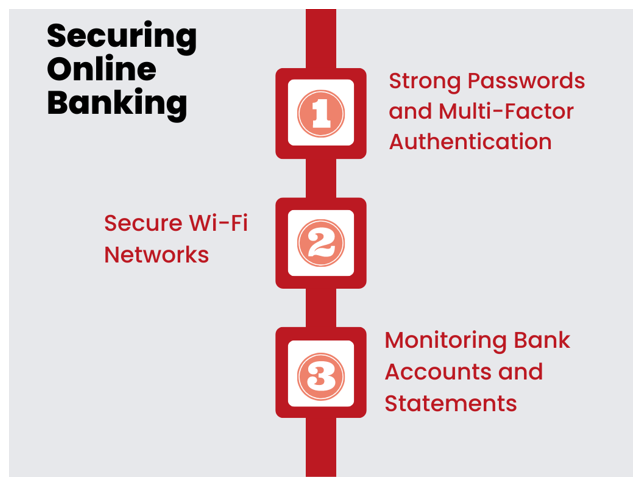

Securing Online Banking:

Strong Passwords and Multi-Factor Authentication:

Your online banking can be made much more secure by using multi-factor authentication and strong, one-time passwords. Think about the following advice:

- When creating passwords, mix uppercase, lowercase, numerals, and special characters.

- When creating passwords, stay away from utilizing information that is simple to guess, including birthdates or pet names.

- Enable multi-factor authentication, which ups security by requiring a second verification method, such as a unique code sent to your mobile device.

Secure Wi-Fi Networks:

To protect your online banking transactions, make sure to use secure Wi-Fi networks. Take the following actions:

- Avoid using public Wi-Fi networks for essential tasks like banking because they could be subject to spying.

- Use a strong password and encryption to protect your home Wi-Fi network.

- If you want to protect your data when connecting to the internet from unsecured or public networks, think about using Virtual Private Networks (VPNs).

Monitoring Bank Accounts and Statements:

For the purpose of catching any unlawful activity, it’s critical to often monitor your bank accounts and statement. Consider the following actions:

- Regularly review your bank transactions and statements to look for any erroneous or questionable charges.

- Configure account alerts to get notifications for certain actions, such as sizable transactions or changes to contact information.

- Immediately notify your bank of any unlawful transactions or questionable activity.

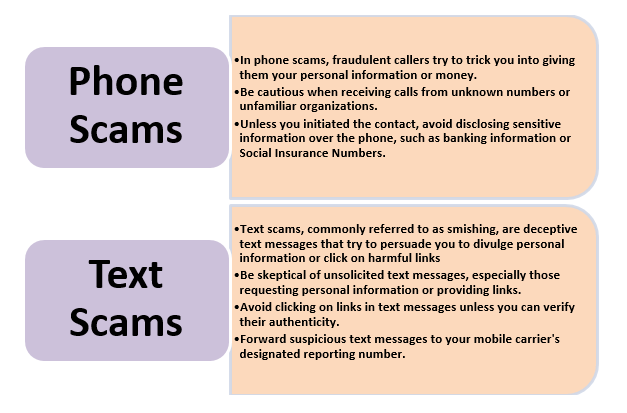

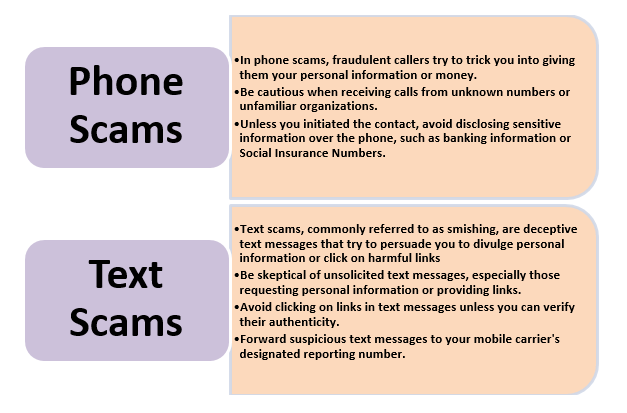

Staying Vigilant Against Phone and Text Scams:

Seeking Help from Banking Professionals:

Contacting Your Bank:

If you encounter suspicious activities or have concerns about scams, reach out to your bank’s customer service. Take the following steps:

- Report any fraudulent transactions or activities promptly to your bank.

- Seek guidance on securing your accounts, such as changing passwords or setting up additional security measures.

- Follow your bank’s instructions for further investigation or resolution.

Consulting Fraud Prevention Resources:

- Banks provide various fraud prevention resources to help their customers. Utilize these tools and services:

- Attend workshops or seminars organized by your bank to learn about fraud prevention strategies.

- Access online guides, articles, and educational materials provided by your bank.

- Stay informed about fraud prevention initiatives and resources offered by your bank.

Conclusion:

Scams and fraud pose significant risks to our financial security and well-being. By following expert guidance from GTA’s banking professionals, we can fortify ourselves against these threats. Understanding common scams, securing online banking, staying vigilant against phone and text scams, educating ourselves, and seeking help when needed,these are the key steps to safeguarding our finances. By taking proactive measures and spreading awareness, we can create a safer banking environment and protect ourselves and our loved ones from scams and fraud in the GTA and beyond. Remember, knowledge and vigilance are the strongest defenses against scams and fraud.