Managing Student Loans in the GTA: Repayment Options and Strategies

Higher education is often made more difficult by the expense of student debt. The Greater Toronto Area (GTA) has a large number of university graduates who still owe money. The strategies and options for repayment that are available must be understood to manage student loans effectively and lessen the stress that comes with them. This article will discuss the many approaches to managing student loan repayment in the GTA.

Know Your Student Loan

It’s critical to comprehend the sort of student loan you have before diving into repayment options. Federal and provincial student loans are offered in Canada.

Canadian student loan types:

Federal loan and provincial loans are the two primary categories of student loans in this country.

Federal Student Loans:

- In Canada, federal student loans are managed by the National Student Loans Service Centre (NSLSC).

- Students around the country receive financial help from them.

Provincial Student Loans:

- There is a unique set of provincial student loans for each province or territory.

- The qualifying requirements, application procedure, and Periods of repayment differ by province.

Terms & Conditions:

- It’s essential to develop as familiar with the guidelines that apply to your particular student loan.

- These comprise the sum borrowed, the interest rate, the grace period, the start date of repayment, and any additional costs.

Interest rates:

- In Canada, the interest rates on both federal and provincial student loans are fixed.

- Depending on the loan type, the year of study, and the current interest rate rules, and rates could vary.

Payback criteria:

- There are different payback criteria for each student loan.

- It’s essential to be aware of the start date of your loan payback term, the length of the loan, and the minimum monthly payment amount.

Programmes for Repayment aid:

- Borrowers who are having trouble paying back their student loans can take advantage of repayment aid programs offered by federal and provincial student loan programs.

- By income and family size, these programs provide choices like decreased or stopped payments.

Communication & Updates:

- Keep abreast of any alterations or developments about your student loan.

- For timely alerts and changes, make sure the appropriate loan service providers have your most current contact information.

Explore Repayment Options

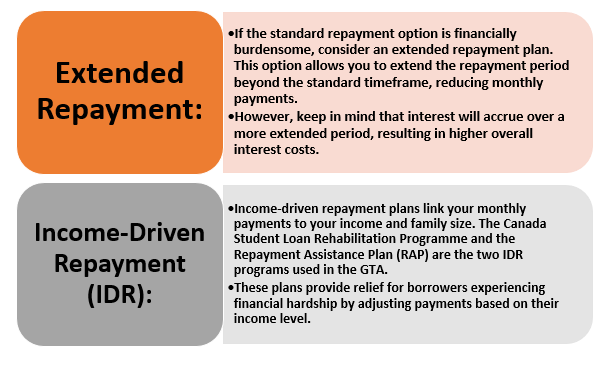

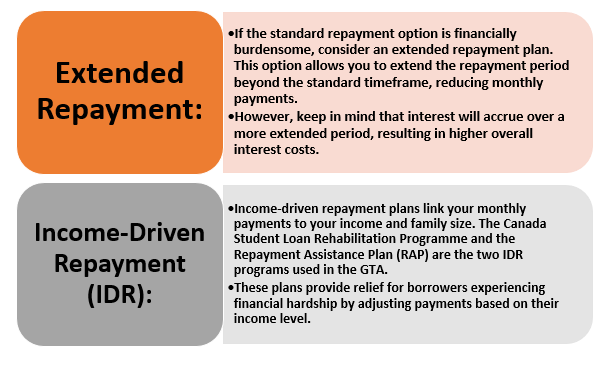

Standard Repayment: The standard repayment option involves paying off your loan within a fixed period. Monthly payments are determined based on the loan amount and interest rate. This approach ensures that you repay your loan in a reasonable timeframe, but it may result in higher monthly payments.

Utilise Repayment Assistance Programs

Repayment Assistance Plan (RAP):

- RAP offers financial relief to individuals who are struggling to make their student loan payments.

- You can be qualified for reduced or even suspended payments depending on your income and family size.

- Applying for RAP can help ease the financial burden while you work on improving your financial situation.

Loan Rehabilitation:

- If you have fallen behind on your student loans, you may be eligible for loan reinstatement under the Canada Student Loan Rehabilitation Programme.

- By making a series of affordable, consecutive payments, you can demonstrate your commitment to repayment and have your loan rehabilitated.

- This program helps rebuild your credit and eligibility for other financial benefits.

Prioritize Loan Repayment

Create a Budget:

- Developing a budget allows you to allocate funds for your student loan payments.

- Keep track of your income and expenses to identify areas where you might reduce spending and increase loan repayments.

- To measure your progress and keep on target, take into consideration using budgeting applications or spreadsheets.

Make More Payments:

- Try to always pay more than the required minimum.

- You may dramatically cut the amount of interest you’ll pay overall and shorten the payback time by making even a few more small payments.

- You should utilise any additional funds, such as tax refunds or bonus payments, to pay off your student loans.

Consider refinancing or combining:

- Refinancing entails replacing your current loans with a new loan, sometimes at a reduced interest rate. Consolidating debts makes payments easier by combining several loans into one.

- These options can potentially lower your interest rate, reduce monthly payments, and streamline your loan management.

Conclusion

Managing student loans in the GTA requires careful consideration of repayment options and the implementation of effective strategies. By understanding your loan terms, exploring various repayment options, and taking advantage of available assistance programs, you can alleviate the financial stress associated with student loans. Prioritizing loan repayment through budgeting, increasing payments, and exploring refinancing or consolidation opportunities will enable you to become debt-free sooner. Remember, proactive management and financial planning are key to successfully navigating the repayment journey and achieving long-term financial stability.