Short-Term Vs. Long-Term Disability Insurance in Canada: Which One to Choose?

Have you ever thought about what would happen if you got hurt and couldn’t work for a while? It’s a scary thought, right?

According to the Canadian Life and Health Insurance Association Inc. (CLHIA), one out of every three people might face a disability lasting 90 days or more before they turn 65. And some disabilities can stick around for months or even years.

That’s where disability insurance comes in to help you out.

But here’s the thing, there are two types of disability insurance in Canada, namely short-term and long-term disability insurance. Now, the big question is: which one should you get?

So, let’s take a closer look at both insurance plans to help you make the right choice.

What’s Disability Insurance?

Disability insurance is like a backup plan for when you are unable to work due to illness or injury. It gives you money to help pay for things like rent, food, and bills when you can’t earn money.

For instance, AMA disability insurance is very popular in Canada. It provides financial protection in the form of monthly income benefits. These income benefits can be used to take care of bills and other expenses.

What are Long-Term and Short-Term Disability Insurance?

Definition: Short-Term Disability Insurance (STD)

Short-term disability insurance covers short periods, like up to 6 months, when you can’t work due to illness or injury. It gives you money to replace some of your income during this time. It pays you a weekly benefit to help cover your regular expenses like rent and groceries while you’re recovering.

Definition: Long-Term Disability Insurance (LTD)

Long-term disability insurance kicks in when you’re unable to work for more than six months due to an illness or injury. Instead of weekly payments, LTD gives you monthly income replacement.

It starts when short-term disability, sick leave from work, or Employment Insurance (EI) sickness benefits end. Essentially, it’s a financial lifeline for the extended period when you can’t work.

Common Functioning: Let’s say Mr. James hurt his leg and can’t go to his job for a few weeks. With disability insurance, he will get a portion of his usual paycheck during that time to help cover his expenses, like rent and groceries. However, if he does not have any such insurance, he will be left with no choice but to pay off expenses from his own pocket.

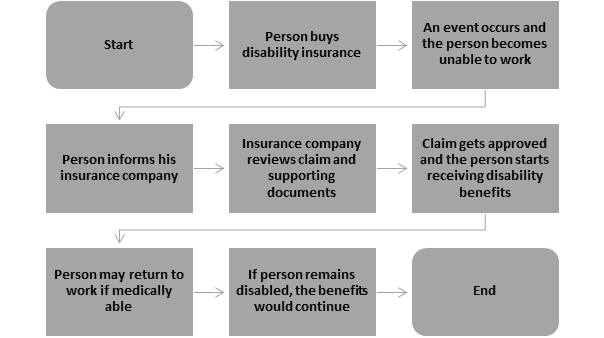

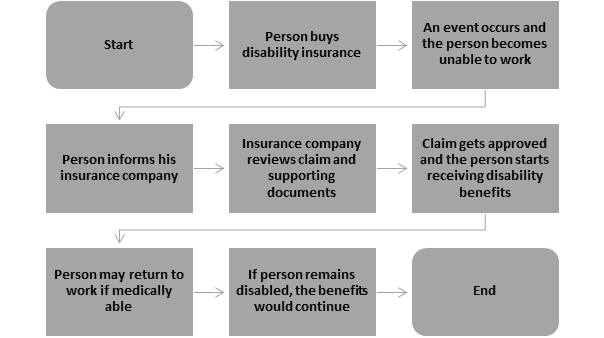

Here’s a simple flow chart explaining how disability insurance works in Canada!

What are the Key Differences in FEATURES and BENEFITS of Short-Term and Long-Term Disability Insurance?

Let’s have a detailed comparison between long-term and short-term disability insurance:

- Duration of Coverage

STD insurance steps in when you’re temporarily unable to work due to an injury or illness. It’s like a safety net for short-term setbacks, offering financial support typically for a few weeks to up to 6 months.

On the other hand, LTD insurance is there for more serious and prolonged situations. It assists for an extended period, for up to 2 years. Sometimes it offers coverage until retirement age.

- Amount of Benefit

STD typically replaces a significant portion of your paycheck, sometimes even covering all of it. The benefit amount is determined by how much you earn each week. This can be between 50% to 100% of your paycheck, depending on your insurance plan.

On the other hand, long-term disability insurance benefits are figured out by looking at how much money you make each month. Usually, it’s around 35% to 70% of what you earn, depending on your policy. The beauty of LTD insurance lies in its ability to provide stability during prolonged periods of disability.

- Waiting Period

In short-term disability insurance, there’s a short wait before you get the money. Sometimes it’s just a few days, but it could be a few weeks.

But with LTD, you have to wait longer to start getting the benefits. This waiting period can be a few months or even years. That’s because the conditions it covers are usually more severe and take longer to recover from.

- Cost

STD insurance doesn’t last for a long time. It’s there to help when you can’t work for a little while because of an injury or illness. Since it covers a shorter time and expects you to go back to work sooner, it usually doesn’t cost as much.

In contrast, LTD insurance is for when you can’t work for a really long time because of a serious injury or illness. It covers you for a longer period and might give you more money. Because of this, it often costs more than short-term disability insurance.

- Inclusions

Sometimes, accidents and illnesses happen out of the blue, and you might get hurt and need medical help right away. Whether it’s a surgery you planned or an emergency one, or it’s a minor illness, you might need time off work to recover. In such scenarios, STD insurance jumps in to give you money while you’re getting better.

However, long-term disability insurance serves a different purpose. It’s for when you have a serious health problem that might last a long time, like a chronic illness such as multiple sclerosis or rheumatoid arthritis. These kinds of illnesses need ongoing medical care and might mean you can’t work for a while. LTD insurance ensures you still have money coming in until you can work again, or even if you can’t work anymore.

Tabular Comparison: STD Vs. LTD Insurance

| Parameters | Short-Term Disability Insurance | Long-Term Disability Insurance |

| Coverage Duration | Up to 6 Months | Up to 2 Years OR Lifetime |

| Amount of Benefit | 50% to 100% | 35% to 70% |

| Waiting Period | Shorter | Longer |

| Cost | Lower | Higher |

| Payment Frequency | Weekly | Monthly |

What To Choose: Long-Term OR Short-Term Disability Insurance?

When deciding on long-term or short-term disability insurance, think about your health, job, and money situation.

If you’ve got some savings or other help for short times when you can’t work, short-term disability might be okay. But if you’re worried about being out of work for a long time and how you’ll pay the bills, long-term disability insurance is good to go.

Conclusion

In a nutshell, each insurance has its own pros and cons. While short-term disability offers a quick fix for temporary setbacks, long-term disability is there to give you long-term support.

So, think about what you need most and what would give you peace of mind. It’s all about finding the best fit for you and your situation.

People Also Ask

Q. Can I get both short-term and long-term disability insurance?

A: Yes, you can have both types of insurance. Short-term insurance helps you in the beginning, and if you need support for a longer time, long-term insurance kicks in afterward.

Q. What if I have a mental illness? Which insurance should I choose?

A: If you have a mental illness that might keep you from working for a long time, LTD insurance is better suited to help you during that period.

Q. Can I get short-term disability insurance if I’m self-employed?

A: Yes, self-employed individuals can often purchase STD insurance to protect their income if they are unable to work due to illness or injury.

Q. If I have a pre-existing condition, can I still get disability insurance?

A: It depends on the insurer and the condition. Some insurers may cover pre-existing conditions after a waiting period, while others may exclude them from coverage.

Q. Are disability benefits taxable in Canada?

A: Disability benefits received from a private insurance policy are usually taxable. However, benefits from government programs like CPP Disability are generally tax-free.