Compare RBC Day-to-Day Banking Account versus National Bank Newcomers Chequing Account

The RBC Day-to-Day Banking Account offers you valuable features at a low fee. If you do less banking and are looking for an affordable chequing account, this chequing account can be the perfect option. Click here to open it instantly.

We have National Bank – Newcomers Chequing Account, which is best suited for newcomers to Canada. You can open this chequing account from your home country up to 90 days in advance. Open it instantly through this link.

Let us compare these chequing accounts and see the perfect option for you.

1. RBC Day-to-Day Banking Account

The RBC Day-to-Day Banking Account manages your day-to-day banking most comprehensively. It offers you several services, including financial calculators, online bill payments to tracking previous transactions.

WELCOME OFFER

This bank account is not offering you any opening cash bonus or introductory benefits.

FEATURES

- Eligibility

| a. | You must be a Canadian resident or a permanent resident |

| b. | Must be a major as per the age of the majority set by your province. |

| c. | You must have your Social Insurance Number (SIN) |

*For account opening purposes, keep in handy the following information:

- Email address

- Phone Number

- Contact information

- Residential status and

- Date of Birth

Interest Rate:

- This chequing account does not offer any interest on balances maintained.

Minimum Balance:

- There is no requirement for any minimum balance

Transactions:

- Unlimited Interac e-Transfer

- You can do 12 free debit transactions every month. Plus, 1 FREE debit transaction per automated payroll deposit up to a maximum of 9 per bank Account.

- Every additional debit transaction will cost you $1.25 per transaction.

Monthly Fees:

- There is a monthly fee of $4

- However, you will get a waiver if you are a senior citizen (aged 60 or more)

Additional Benefits

2. National Bank – Newcomers Chequing Account

National Bank Newcomers Chequing Account offers a perfect solution to the banking needs of all Canadian immigrants. You can open this account in Canada or even from your home country. However, your date of arrival must be in the next 90 days.

WELCOME OFFER

Get a cashback of up to $300 when you open your first bank account.

FEATURES

- Eligibility

| a. | You must be a newcomer. |

| b. | You must be at least 17 years old. |

| c. | You must open your account within 5 years of arriving in Canada or open it from your home country |

Interest Rate:

- You do not get any interest in this chequing account

- Minimum Balance:

- There is no requirement for any minimum balance.

Transaction

| First Year | Second and Third Year |

| You can perform unlimited electronic transactions | You can make electronic payment of two bills per month |

Monthly Fees:

- There is a monthly fee of $15.95

- You are not required to pay any monthly fee in the first year

- You can save the monthly charges in years two and three if you sign up for the products and services

- If you do not sign up, you will pay:

- $7.98 monthly fee in the second year (50% discount)

- $11.96 in monthly charges in the third year (25% discount)

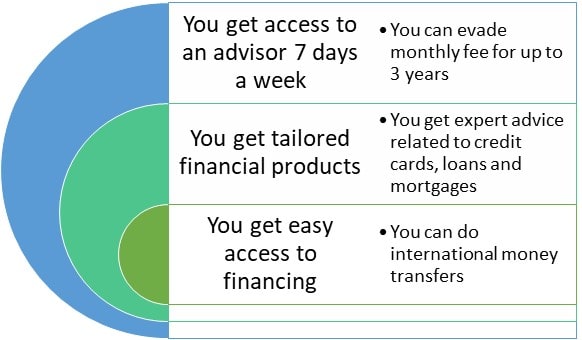

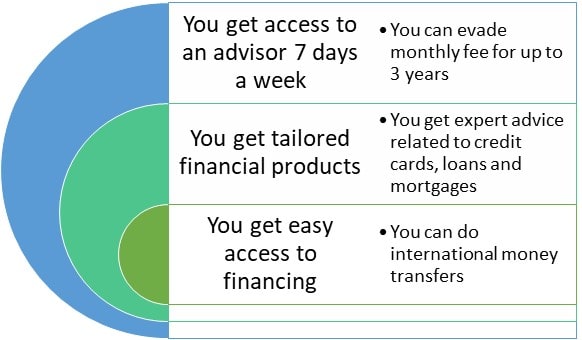

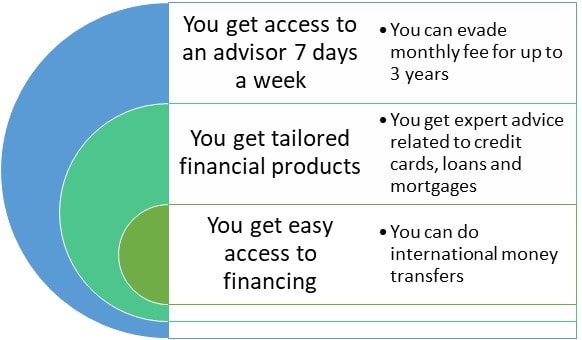

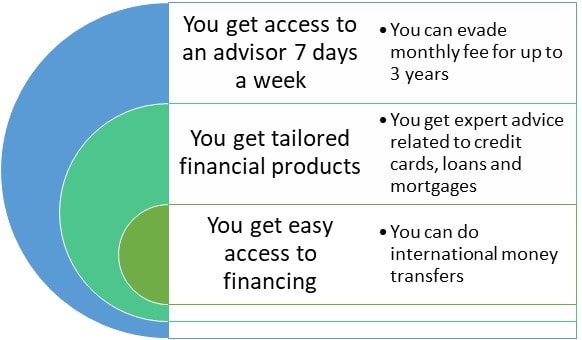

Additional Benefits

COMPARATIVE ANALYSIS

We compare the common features of the accounts through a table.

| Parameters | RBC Day-to-Day Banking Account | National Bank – Newcomers Chequing Account |

| Opening Cash Bonus | $0 | Up to $300 cashback |

| Monthly Fees | $4 | $15.95 |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Free Debit Transactions | 12 per month | Unlimited in the first year, then capped at 2 per month |

Out of the five parameters mentioned above, the RBC Day-to-Day Banking Account scores are better among the two bank accounts. There is a tie in two parameters, while National Bank – Newcomers Chequing Account wins only in one parameter.

OPINION of Expertbyarea.money

The chequing accounts mentioned in this article serve different purposes. If you do minimum banking and are unwilling to own high-fee chequing accounts, RBC Day-to-Day Banking Account can be perfect for you. It even lets you do fuel savings at Petro-Canada.

However, if you are a newcomer and want to open a no-fee chequing account (for up to 3 initial years), National Bank – Newcomers Chequing Account can suit you.

Evaluate your requirements. Choose the best account that better serves your needs.