DUCA Retirement Banking Bundle vs. Comtech Basic 10 Banking Package – Best Retirement Banking Chequing Account

The Retirement Banking offered by DUCA Credit Union is a part of the Feel Free Bundle designed exclusively for senior citizens aged 60 or above. Click here to open this account instantly.

In this article, we will compare this account with the Basic 10 Banking Package offered by Comtech Fire Credit Union. This account is suitable for low-volume users with limited banking needs.

Are you confused? Do not be; instead, enjoy your second childhood with www.ExpertByArea.Money. Here is a detailed comparative analysis of both these chequing accounts

1. DUCA Retirement Banking Bundle – By DUCA Financial Services Credit Union

WELCOME OFFER

Presently DUCA Credit Union is not offering you any opening cash bonus or introductory benefits.

FEATURES

- Eligibility

| a. | You are a Canadian |

| b. | You are 60 years or higher. |

| c. | You have any of your valid government-issued ID, like Passport, Driving license, etc. |

- Interest Rate:

- This chequing account does not offer any interest on balances maintained.

- Minimum Balance:

- There is no requirement for any minimum balance

- Transactions:

- Free 5 debit transactions every month

- Free 5 Interac e-Transfer

- Every additional transaction will cost you $1.25/transaction

- Free Me-to-Me money transfers

- Monthly Fees:

- There is no monthly fee

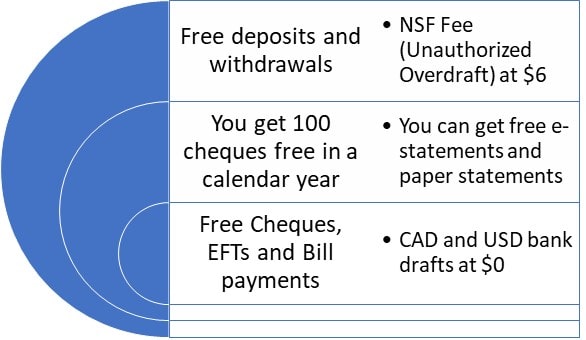

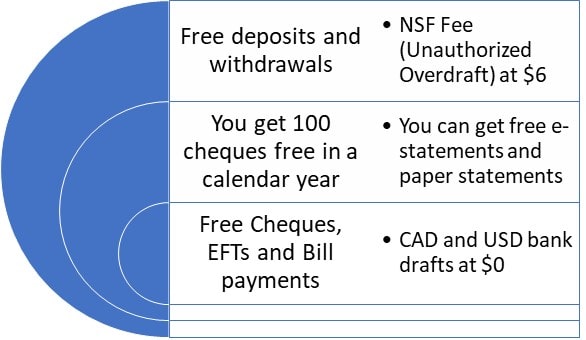

Additional Benefits

2. Basic 10 Banking Package – By Comtech Fire Credit Union

WELCOME OFFER

Comtech Fire CU is not offering you the benefit of any introductory offer or an opening cash bonus.

FEATURES

- Eligibility

| a. | You are a Canadian resident. |

| b. | You have attained the age of majority as per your province. |

| c. | You have a valid government-issued ID, like a Driving License, passport, etc. |

Interest Rate:

- You do not get any interest in this chequing account

Minimum Balance:

- There is no requirement for any minimum balance.

Transactions:

- You get ten free day-to-day transactions every month

- The day-to-day transactions include:

- Cheque clearing

- Debit card payments (point of sale)

- In-branch withdrawals

- Me-to-me Transfers

- Pre-authorized payments

- Bill payments (In-branch, Online, Mobile, and Call Centre)

- Transfers (In-branch, Online, Mobile, and Call Centre)

- CFCU, ACCULINK®, and THE EXCHANGE® Network ATM withdrawals and transfers

Monthly Fees:

- There is a monthly fee of $5

- However, if you are 59 years or above, you get this account at $0

- If you are less than 59 years, you are required to maintain a minimum balance of $1,500 to waive the fee

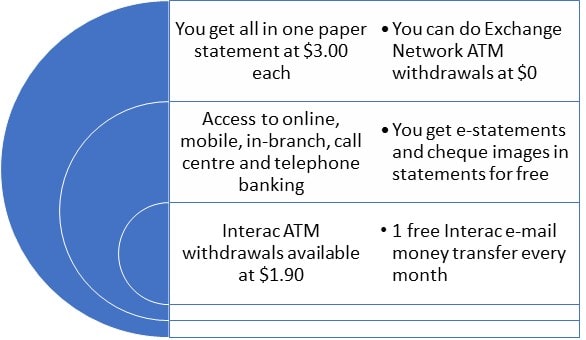

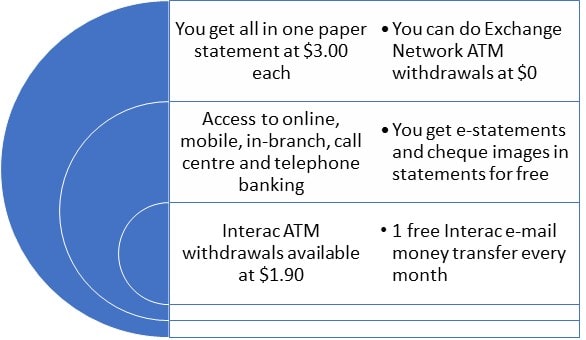

Additional Benefits

COMPARATIVE ANALYSIS

We compare the features of the accounts through a table.

| Parameters | DUCA Retirement Banking Bundle – By DUCA Financial Services Credit Union | Basic 10 Banking Package – By Comtech Fire Credit Union |

| Monthly Fees | $0 | $5 ($0 if you are 59+) |

| Interest Rates | 0.00% | 0.00% |

| Minimum Balance | Not applicable | Not applicable |

| Free Debit Transactions | 5 | Combined limit of 10 |

| Free Interac e-Transfers | 5 | Combined limit of 10 |

| Me-to-Me Money Transfers | Unlimited and Free | Combined limit of 10 |

Out of the six parameters mentioned above, DUCA Retirement Banking Bundle scores higher in four. There is a tie between the other two.

OPINION of ExpertByArea.Money

Being the fourth largest credit union in Canada, DUCA certainly lives up to its expectations. The DUCA Retirement Banking Bundle is a delight for most senior citizens as they get access to quality banking services at a $0 monthly fee.

There are five free debit transactions and Interac e-Transfer, while Me-to-Me money transfers are free. The seniors get 100 free cheques in a calendar year with free bank drafts, statements, EFTs (Electronic Fund Transfer), and bill payments.

The Comtech Fire Credit Union has a comparatively limited presence and imposes too many banking restrictions. The Basic 10 Banking Package only allows ten transactions/month, including debit transactions, Interac e-Transfer, Me-to-Me money transfers, etc. You also do not get any free bank drafts or cheques.

Evaluate your requirements. Choose the best account that better serves your needs.